Ethereum price has been under intense pressure for the past few weeks as the demand for cryptocurrencies wanes. The world’s second-largest cryptocurrency has crashed more than 70% this year and more than 18% in the past month. At the time of writing, Ethereum had slipped 1.50% to $1,185. The total volume of ETH traded over the last day has slumped by more than 20%.

Crypto Market Outlook

Ethereum price has been under intense pressure after hackers stole around $477 million in cryptocurrency from FTX. The hackers converted more than half the amount to Ether before dumping the holdings into another cryptocurrency.

The overall crypto market has been on a strong downward trend as demand for digital currencies slows down. According to data by CoinMarketCap, the global crypto market cap has dropped by nearly 2% in the last day. The total crypto market volume has dropped by 23% over the last 24 hours.

The crypto market is still on edge after the second-largest cryptocurrency exchange in the world. Investors are anxious that there could be contagion from the collapse of FTX, a once $32 billion empire. Investors have been looking for signs of other companies that may have had exposure to the exchange firm.

Bitcoin’s slump to a fresh 2-year low has also weakened the overall crypto sentiment. Being the world’s most valued cryptocurrency with a dominance of about 38.97%, Bitcoin’s performance affects the overall outlook of the cryptocurrency market. Bitcoin has been stubbornly hovering above the critical support level of $16,000.

However, Binance, the world’s largest cryptocurrency exchange announced on Thursday that it would be devoting $1 billion to the crypto recovery fund. The company’s CEO said that they would increase the amount to $2 billion in the future, where need be. Their commitment is due to the crypto contagion fears all over the market.

Ethereum Price Analysis

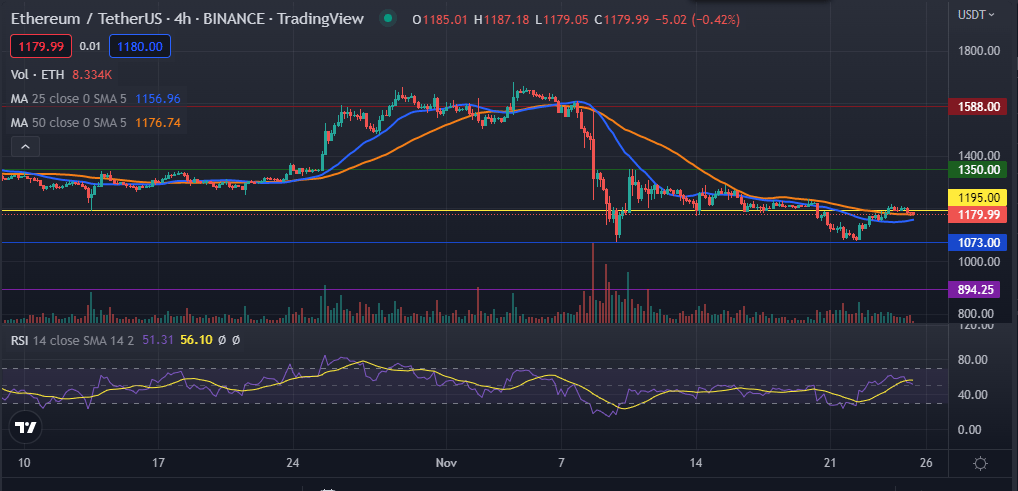

The 4-hour chart shows that the Ethereum price has been on a strong bearish run for the past few weeks. It hit an intraday high of $1,204 before pulling back. It has managed to move above the 25-day moving average and is trading slightly along the 50-day moving average. Its Relative Strength Index (RSI) is neutral at 56.

Therefore, with the decline in momentum, the ETH price’s current outlook is likely to hold for the weekend as traders look to flipping the hurdle at $1,195. If this happens, Ethereum will easily make its way to the key resistance levels at $1,290 and $1,350.