Bitcoin price bounced back above the critical level of $20,000 after trading below it earlier on Monday. The risk-on asset is attempting to recover after the Fed Chair’s hawkish statement on Friday.

Fundamentals

On Friday, during the highly anticipated Jackson Hole symposium, Jerome Powell reiterated that the US central bank is keen on dealing with the high inflation despite the probable economic pain. As has been the case in recent months, an environment of high interest rates tends to be bearish for Bitcoin price and the broader class of cryptocurrencies. This is largely because these assets are largely speculative. Since hitting its highest level year-to-date at $48,233.52, it has dropped by over 50%.

In the ensuing sessions, investors will be keen on the nonfarm payrolls set for release on Friday. The numbers may offer further cues on the Fed’s next move.

In addition to the Fed’s hawkish stance, Bitcoin price movements will also be influenced by the expected volatility in the stock market. Cryptocurrencies tend to move in tandem with the US stock market; another class of risk assets.

Bitcoin price prediction

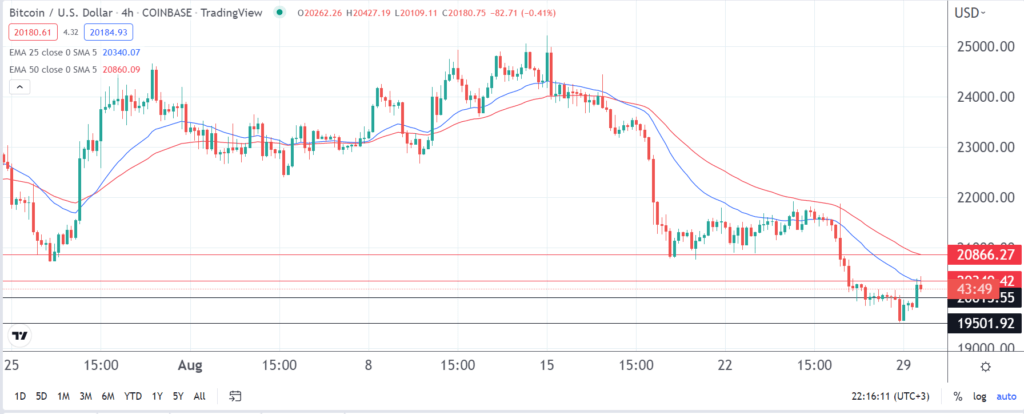

BTC/USD traded below the critical level of $20,000 earlier on Monday before parring some of those losses. Even so, it remains below $21,000 as the risk-off mood persists. Interestingly, the aforementioned zone offered steady support to the digital asset for about a month until late last week. As at the time of writing, Bitcoin price was up by 2.95% at $20,125.93.

In the short term, I expect the crypto to continue hovering around $20,000. From this perspective, the 25-day EMA at $20,340.42 will be a resistance level worth watching. Even with a further rebound, it will likely continue to trade below $21,000. In particular, its gains may be curbed along the 50-day EMA at $20,866.27. On the lower side, a move below $20,000 will have the bears eyeing $19,500.