Bitcoin price remained on a consolidation pattern in early Friday trade. With the December Fed meeting in focus, the crypto may continue to hover around $17,000 for a while longer. As at the time of writing, BTC/USD was up by 2.32% at $17,231.52.

Fundamentals

Uncertainty over the Fed’s monetary policy has seen bitcoin price consolidate since mid- last week. Since March when the Fed began tightening its monetary policy, the leading crypto by means of market capitalization has dropped by close to 65%.

With the persistently high inflation and tight labor market, there are concerns that the US central bank will remain hawkish in the December meeting scheduled for 13th and 14th. In fact, the jitters are observable in the crypto fear & greed index.

The crypto market saw a slight improvement to a fear level of 27 in the previous week and 29 in the previous session. However, it is back to an extreme fear level of 25. With the persistent risk aversion, bitcoin price may continue to trade below the previously steady support of $18,000 for a while longer. Besides, FTX contagion concerns are still at the back of investors’ minds.

Bitcoin price outlook

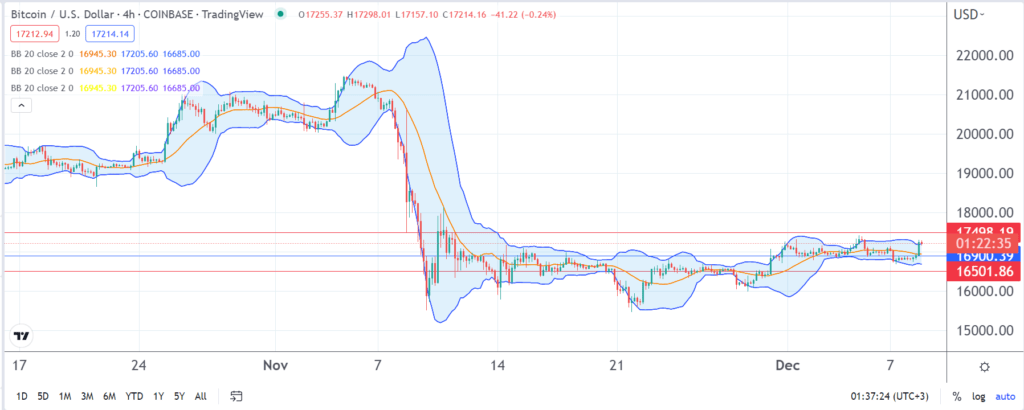

BTC/USD has recorded rather subtle movements over the past one-and-a-half weeks. As seen on its four-hour chart, the bollinger bands have been contracting since last weekend. Based on these technical indicators, coupled with the fundamentals, the market will likely record lower volatility into the weekend.

With the highly anticipated Fed meeting in the horizon, bitcoin price movements will likely be subtle over the weekend. In particular, 16,900 remains a support level worth watching.

Amid the persistent risk-off mood, a further pullback will give the bears an opportunity to retest the psychologically crucial zone of 16,500. However, a move above the resistance level at 17,500 will invalidate this bearish thesis.