Bitcoin price has been in a freefall for the past few days, suggesting increased profit-taking by investors. At press time, Bitcoin was trading 0.77% lower at $27,375.42. BTC’s total market cap has crashed over the past few days to $529.8 billion, while the total volume of the digital asset traded moves slightly higher.

Fundamentals

Bitcoin price has been under immense pressure for the past few days as markets price in a potentially hawkish Fed. Markets have been cautious amid rumors of a 25-basis point rate hike by the Federal Reserve in its next monetary policy meeting in May. Most Fed officials have expressed their support for the rate hikes in a bid to tame the persistent inflation. Hiking of interest rates poses a bearish sentiment for risk assets such as stocks and cryptocurrencies.

Statistics by Coinmarketcap show that the global crypto market cap has collapsed to $1.15 trillion, down from its highest level this year at $1.27 trillion. Bitcoin’s dominance has also slipped from its highest level this year to 45.27%. However, the total crypto market volume has continued rising, inching more than 35% higher over the last day.

The recent plunge in the BTC price suggests that traders have been booking profits in fear of an imminent downtrend. Bitcoin, the largest digital asset by market cap, recently hit its highest level this year at $30K off the back of Ethereum’s Shanghai upgrade. Even so, the price did not hold this position for long due to profit-taking by investors.

Even so, the recent pullback in the Bitcoin price could prompt buying interest which could pump liquidity, pushing the BTC price higher. Most assets tend to form higher lows when emerging from bearish trajectories. These levels function as staunch support during price corrections. As such, the current downtrend could form a higher floor for BTC, acting as a launch pad for its next rally.

Bitcoin Price Forecast

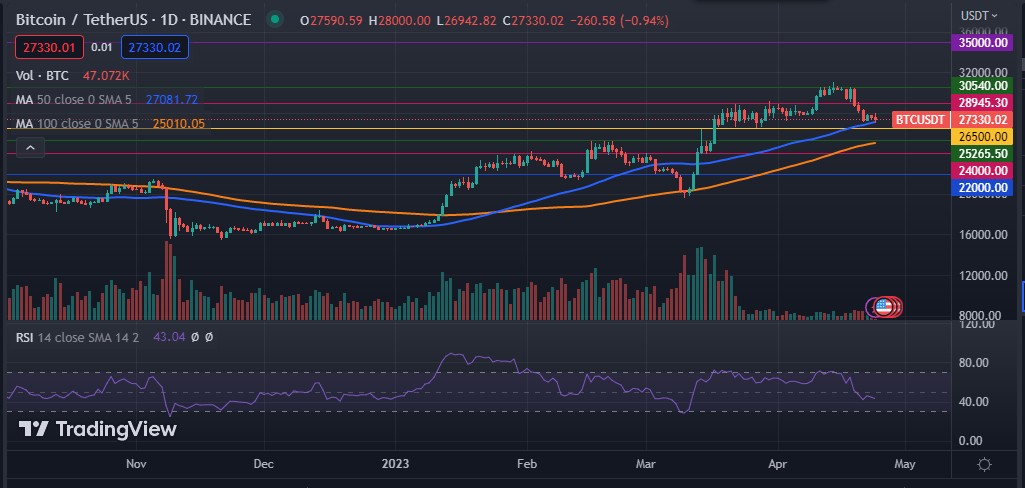

The daily chart shows that the Bitcoin price has been on a sharp decline for the past few days, plummeting more than 10% in the past week. The cryptocurrency has managed to remain above the 50-day and 100-day moving averages, as well as the 50-day and 200-day exponential moving averages. Its RSI has dropped below the neutral zone.

I expect the Bitcoin price to continue falling in the short term before experiencing a price correction. If this happens, the next logical support targets will be $26,500 and $25,265.50 along the 100-day MA. On the other hand, a move past the important level of $28,945.30 will invalidate my bearish thesis.