Rio Tinto share price ASX ended the week in the red, building on losses from its previous trading session as investors digest its Q1 earnings. The mining stock ended Friday’s trading session 2.77% lower at A$117. The company’s total market cap has slipped to A$173.70 billion.

RIO is Slipping

Rio Tinto share price has been under intense pressure for the past few days after the iron ore giant released its quarterly production numbers. Rio Tinto is one of the world’s largest iron ore producers. Over the first three months to March 2023, Rio Tinto produced 79.3 million tonnes of iron ore, an 11% increase compared to a year earlier.

Aluminum production rose 7% in the first quarter, while Bauxite production fell 11%. Copper production remained unchanged over the quarter, while titanium dioxide slag production climbed 4%. Production at Rio Tinto’s Kennecott copper operation crashed by 36% in the wake of record snowfall and the failure of a conveyor belt.

The Australian miner dropped its full-year copper production guidance to between 590 kilotons and 640 kilotons. The guidance reduction was mainly because of the conveyor outage in its Kennecott and geotechnical concerns in Escondida’s open pit. All other full-year production guidance remained unchanged.

While markets remain disappointed with Rio Tinto’s production in the first quarter, Goldman Sachs seems to remain positive. The broker kept its conviction “buy” rating with a slightly trimmed price target of $136.20.

Rio Tinto Share Price Forecast

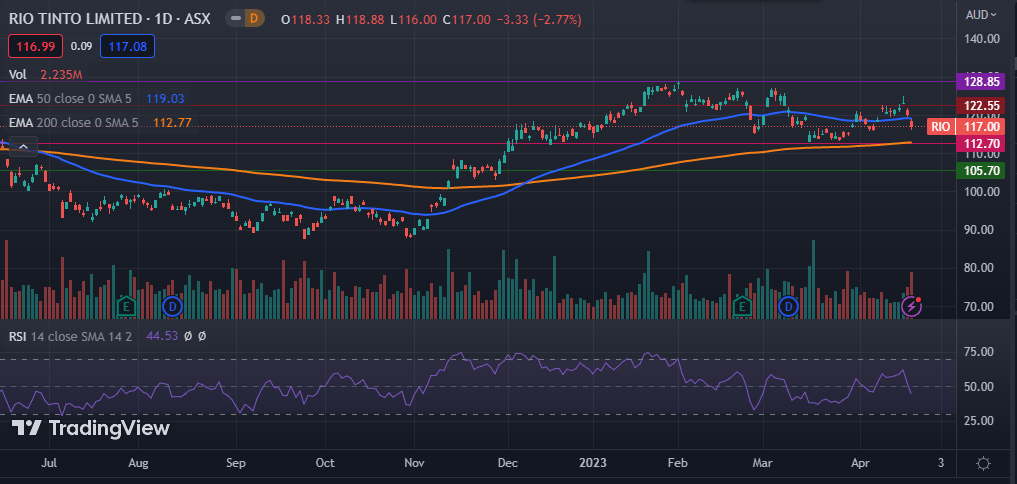

Rio Tinto share price has been in the red for the past few days, falling 3.41% in the past week. On the daily chart, it has managed to move below the 25-day and 50-day moving averages. It has also moved below the 50-day EMA but remains above the 200-day exponential moving average. Its Relative Strength Index (RSI) has ticked lower below the neutral zone.

Most commodities have been flashing red for the past few days off the back of a potential hawkish Fed. As such, the Rio Tinto share price is likely to fall further in the medium term as bears eye the next logical support level along the 200-day EMA at 112.70. However, a move past the 122.55 level will invalidate this bearish view.