The Faraday Future stock price went parabolic on Friday as volume for the EV company soared. FFIE shares jumped by more than 36% and closed at $3.55. This price is about 109% above the lowest level this year. Its market cap is at $1.07 billion, which is about 83% below its all-time high of almost $10 billion.

What is Faraday Future Intelligent Electric?

Faraday Future is an electric car company that is building four vehicles to compete with incumbents like Tesla, Ford, and General Motors.

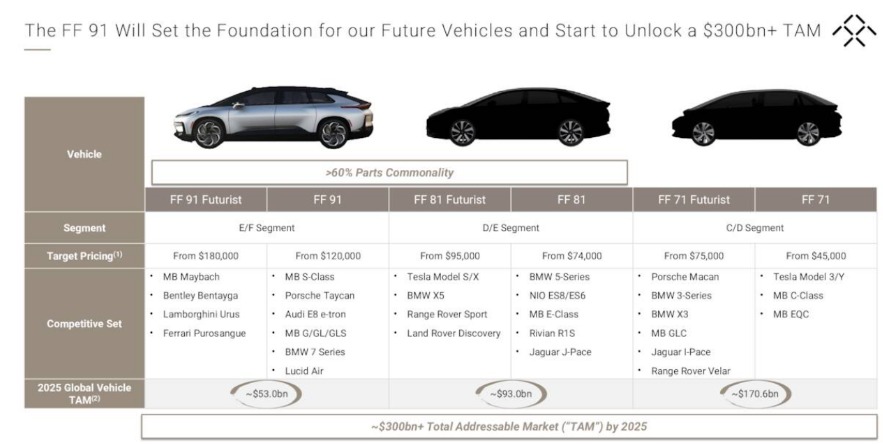

Headquartered in California, the firm is building four car brands. Its FF 91 series is a premium car that can move from 0-60 mph in less than 2.5 seconds. FF 91 Futurist will start at $180k while the basic version will sell for $120k.

Faraday Future is also building FF 81 series that is aimed at the mass market. The vehicle will have about 60% parts similar with FF 91 and will start at $74,000. The other vehicles are FF 71 series and a last-mile delivery car.

Faraday Future is one of the many EV companies that are seeing to become major players in the auto sector. However, like most startups, the firm is finding it extremely difficult to compete as competition and cost of doing business rise.

Why has the Faraday stock price crashed?

Faraday Future share price has been in a strong downward trend in the past few months. There are several reasons for this price action. First, the decline is in line with the performance of other EV stocks. For example, Tesla shares have fallen by over 45% from its highest point this year, bringing its market cap to more than $706 billion. At its peak, Tesla was valued at more than $1 trillion.

Other EV stocks have also fallen. Rivian shares have fallen from its all-time high of $181 to the current $25. Lucid Group stock has fallen from almost $60 to the current $17. The closely-watched iShares Self-Driving and Tech ETF has crashed by 35% from its all-time high.

Second, the FFIE stock price has dropped sharply in line with the performance of other SPAC companies. Most stocks that were listed via a SPAC merger have nosedived. Indeed, the Defiance Next Gen SPAC Derived ETF has fallen by over 62% from its all-time high.

Third, the cost of building EVs has jumped due to the rising. Wages in California, where Faraday is headquartered, have risen. Similarly, the price of top commodities that are useful in EV manufacture have all risen. These are metals like copper, nickel, and lithium. As a result, EV companies like Tesla have been forced to boost their prices. This is expected to hit demand.

Further, with interest rates rising, unprofitable companies have fallen out of favor among investors. Recently, we published about companies like Boxed and Affirm that have slumped.

Faraday investigations

The Faraday Future stock price has also crashed because of internal issues. In April this year, the company demoted its founder and CEO, Yueting Jia. He is now the Chief Product Officer. The demotion added to multiple troubles that have accompanied the company since it was started in 2014.

The company also came under scrutiny from regulators and the Justice Department. The SEC is investigating whether the company misled investors in its official documents. A good example of inaccurate statements was about the number of reservations.

The company said that it has received over 14,000 reservations for its FF 91 vehicle. In reality, only a few of those orders were paid. In the most recent report, the company said that its FF 91 Futurist model had 401 preorders.

Therefore, it is extremely difficult to recommend buying the Faraday stock in a time when it is facing significant regulatory and legal scrutiny.

Another concern for Faraday Future is its high short interest, which currently stands at about 30%. This means that many inventors believe that the shares will continue falling in the coming months. Most importantly, there are concerns about its balance sheet as it ramps up production and launches in China.

In the most recent statement, the company said that it had $275 million in cash. Therefore, it will likely sell more shares to finance its production.

Faraday Future stock price forecast

The daily chart shows that the Faraday Future share price has been in a strong bearish trend in the past few months. It fell to a low of $1.71, which was its all-time low. Now, it has bounced back and retested the important resistance level at $3.60. This price action is part of a break and retest pattern. As such, I expect that the shares will resume the bearish trend in the near term.