Bitcoin price dipped below its crucial support level at $26,500 on Wednesday, with global market sentiment rattled by uncertainty around the US debt ceiling talks. At the time of writing, the digital currency was trading 3.71% lower at $26,208.21. Bitcoin’s total market cap plunged to $508 billion, while the coin’s total volume inched lower.

Bitcoin is Crashing

Bitcoin price was in freefall on Wednesday amid weakening global sentiment on the back of stumbled US debt ceiling talks. The global crypto market cap plummeted 3.32% to $1.10 trillion on Wednesday, compared to the previous day. The total crypto market volume increased by 10% over the last day, suggesting an increase in selling pressure among traders. Bitcoin’s dominance also dropped over the same period.

Bitcoin, the largest cryptocurrency by market cap, dropped below its crucial support level on Wednesday as statistics showed a massive transfer of the token by a slew of whales. According to Whale Alert, anonymous wallets transferred more than a billion dollars’ worth of Bitcoin in the past 24 hours. In total 43,236 BTC tokens were transferred worth nearly $1.14 billion.

The Ethereum price was also in the red after Wall Street open on Wednesday, dropping to $1,785. The fall of the heavyweights, Bitcoin and Ethereum has seen altcoins, including Dogecoin, Solana, Litecoin, and Shiba Inu, among others, dip by more than 4% over the past 24 hours.

The impasse of US debt ceiling talks in Washington has buoyed the US dollar higher despite the possibility of an economic recession in the US. Short-term Treasury yields held near two-decade highs on Wednesday as investors fretted at the prospect of an unprecedented US government default early in June.

Ramped-up bets by traders that the US Federal Reserve is likely to raise interest rates higher in its next meeting in June have also boosted the US dollar. Some of the Fed’s heavyweights, including Federal Reserve chair Jerome Powell, have sounded their support for higher Fed funds rates in June. As such, the cryptocurrency sector is likely to experience increased market volatility seeing that an environment of higher interest rates tends to be bearish for risk assets such as stocks and cryptocurrencies.

Bitcoin Price Analysis

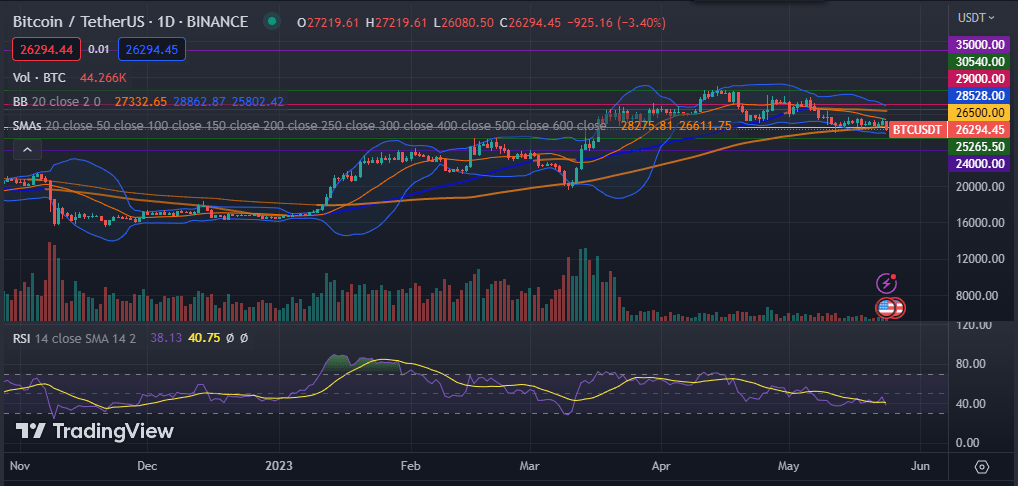

The daily chart suggests that the Bitcoin price is likely to undergo a trend reversal to the downside, breaking out of its consolidation mode. The asset has managed to move below the 50-day and 100-day exponential moving averages, as well as the 50-day and 100-day simple moving averages. Its Relative Strength Index (RSI) has slipped below the signal line to 38, suggesting an increase in selling pressure.

The Moving Average Convergence Divergence (MACD) indicator has remained in the red, suggesting a bearish trend. Increased market volatility is evident from the expanded Bollinger Bands, with the lower band serving as the next support level.

Consequently, the Bitcoin price is likely to fall further in the immediate term as macroeconomic factors weigh on the asset’s outlook. The next support levels to watch will be $25,810 and $25,265.50. On the other hand, a flip past the 50-day EMA will invalidate the bearish thesis.