Bitcoin price was trading slightly higher on Tuesday ahead of the Fed’s interest rate decision scheduled for Wednesday. The largest cryptocurrency by total market cap has been hovering above its highest level in 9 months for the past few days. BTC recorded a slight decline on Monday amid a global slump in the cryptocurrency market. The coin’s total market cap has slipped to $540 billion over the last day, while the total volume of the coin traded dropped by more than 25%.

Fundamentals

Bitcoin price has been hovering above the $26,500 level for the past few days, its highest level since June 2022. At the start of the week, Bitcoin hit an intraday high of $28,500 before pulling back. The crypto market leader has recorded substantial gains over the past few days amid the recent debacle in the banking sector.

The collapse of three major banks, Silvergate Bank, Signature Bank, and Silicon Valley Bank, saw the banking sector slump. Major banking stocks such as First Republic Bank and Credit Suisse recorded massive losses in their shares following the recent contagion fears in the sector. The banking crisis pumped liquidity in the crypto market, prompting a surge in most cryptocurrency prices.

However, the largest Swiss financial institution recently came to the rescue of banks after announcing a merger deal. UBS announced on Sunday that it would acquire Credit Suisse for $3.25 billion in a bid to secure financial stability and protect the country’s economy. The bank’s announcement saw the Bitcoin price, as well as the coin’s dominance rocket to their highest level in 54 weeks.

Focus has now shifted to the US Federal Reserve’s interest rate decision. The Fed’s two-day policy meeting is scheduled to end on Wednesday. Traders expect a smaller rate increase of 25-basis-point, a turnaround from the expected 50-basis-point anticipated earlier this month before a slip in the latest CPI reading.

Bitcoin Price Analysis

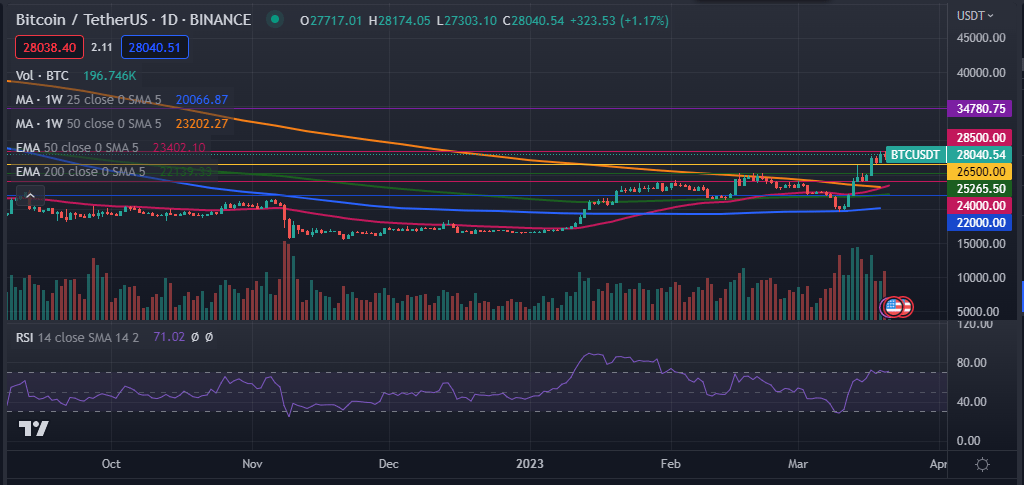

Bitcoin price has been rallying for the past few days, jumping more than 15% in the past week and nearly 69% in the year to date. On the daily chart, BTC has managed to remain above the 25-week and 50-week moving averages, as well as the 50-day and 200-day exponential moving averages. Its Relative Strength Index (RSI) has slipped slightly over the last day but remains in the overbought zone.

Therefore, a smaller increase in the Fed’s interest rate is likely to cause a slight decline in the BTC price in the short term. Even so, I expect the Bitcoin price to remain above the crucial level of $26,500 over the period.

The ensuing buying pressure could cause Bitcoin to increase further to retest the $28,500 level. If this happens, Bitcoin price will be facing the next resistance level around the $30,000 and $34.780.75 price range. On the other hand, a drop below the key level of $25,265 will invalidate the bullish thesis.