Zillow stock price has crashed in the past few months as concerns about the housing market remain. The shares dropped to a low of $35 after it published weak quarterly results. That price was about 82% below its all-time high of $208. As a result, the firm has a market cap of over $9 billion, which is remarkably lower than its all-time high of over $50 billion.

Fed rate hikes and the housing market

Zillow Group is a leading company in the housing market that offers solutions to developers and agents. Its primary product is known as Zillow, which helps agents market their homes to millions of buyers around the world.

Zillow owns other popular brands like Hotpads, Trulia, StreetEasy, and Out East. It also offers other software products like ShowingTime, Bridge Interactive, Dot Loop, and Mortech among others.

Zillow has had a tough period in the past few months. For example, the company made headlines when it decided to discontinue its house-flipping business. The business lost billions of dollars after the venture became increasingly uncompetitive.

Now, with the Fed tightening, there is a likelihood that the company will continue going through a slowdown. The bank has already hiked rates by 225 basis points and indicated that it will continue hiking in the coming months. This view was confirmed on Friday when the US published strong jobs numbers.

Additional data have shown that the housing market is cooling. For example, new, existing, and pending home sales have declined sharply in the past few months.

Zillow earnings

It is against this backdrop that Zillow published weak results in August. The company said that its total revenue crashed by 22% in the second quarter to $1.03 billion. Its IMT business segment’s revenue remained flat at $475 million while its Premier Agent revenue crashed by 5%. Rentals revenue fell by 3% while its IMT EBITDA rose by 39% to $186 million.

The firm also lowered its forward guidance. It expects that its Premier Agent revenue will be between $275 million and $295 million. Most importantly, the firm unveiled plans to dilute its shareholding by issuing between 4.5 million and 6.5 million shares. This performance will be partially offset by its share buyback worth over $850 million. The firm’s CFO said:

“We will be active in the near term to cover the dilution from the additional RSUs related to the employee retention plan that we expect will vest over the next couple of years. We will also continue to be opportunistic with capital investment opportunities, including share repurchases.”

Zillow stock price forecast

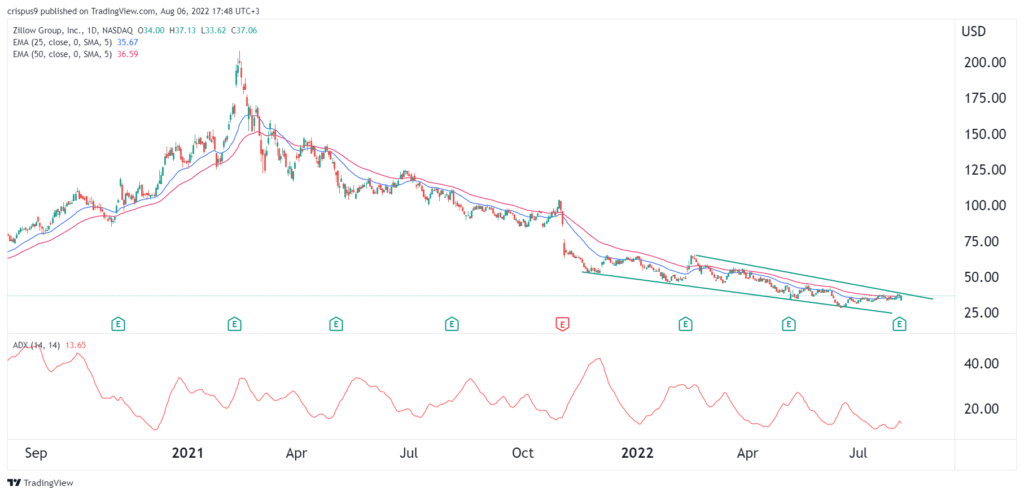

The daily chart shows that the Zillow share price has been in a strong bearish trend in the past few months. A closer look shows that the stock has formed a falling wedge pattern that is shown in green. In price action analysis, this pattern is usually a bullish sign. It is also consolidating along the 25-day and 50-day moving averages while the Average Directional Index (ADX) has retreated.

Therefore, while the housing outlook is difficult, there is a likelihood that the stock will bounce back because of the falling wedge pattern. If this happens, we can’t rule out a situation where the shares jump to about $75. Read our recent report on SoFi.