The Fortescue Metals share price has pulled back in the past few weeks as commodity prices have retreated. The FMG stock is trading at A$16.3, which is about 28% below the highest level this year. The company has a market cap of over a $50.28 billion, making it one of the 11th biggest company in Australia. It is also the largest miner in the country.

Iron ore prices retreat

Fortescue Metals is a large iron ore miner that has operations in Australia. It has three mining hubs in Pilbara, which are then connected to the Herb Elliot Port and the Street Harbour location in Port Hedland. It moves its iron ore through its 760km rail.

Fortescue Metals has been in a strong growth path in the past few years. According to SeekingAlpha, the company’s annual revenue surged from over $8.4 billion in 2017 to over $22.2 billion in 2021.

It has also become extremely profitable as annual profits jumped from $2 billion to over $10.2 billion in the same period. This performance has made Andrew Forrest, the company’s founder, to become the second-richest person in Australia with a net worth of more than $17 billion.

The Fortescue Metals share price has retreated recently because of the ongoing performance of iron ore prices. The price of iron ore declined below $100 per tonne as the outlook for China’s economy dimmed. This decline was the lowest level that iron ore has been since December last year.

Iron ore prices declined as China published weak GDP numbers. The data showed that the economy narrowly avoided contraction although it grew at the lowest pace since 2020. There are also concerns about the housing market, now that many people have stopped paying their mortgages. In a note, an analyst said:

“The COVID restrictions are the most visible but the crackdown on property market speculation and the restriction on carbon emissions are the ones that are really affecting steel production and iron ore demand.”

Is FMG a good buy?

Fortescue Metals has been a good investment in the past few years. Indeed, the shares have jumped by almost 500% in the past five years. As such, it has vastly outperformed the broader ASX 200 and S&P 500 indices.

From a fundamental perspective, the company will likely continue benefiting from the improved Australia and China relationships. Further, Russian sanctions will likely make it see more demand for its products.

However, like I wrote in my South32 share price forecast, there is a possibility that the commodity supercycle is ending. Besides, many countries are now suffering from slow growth, high inflation, and most importantly, an extremely overvalued US dollar.

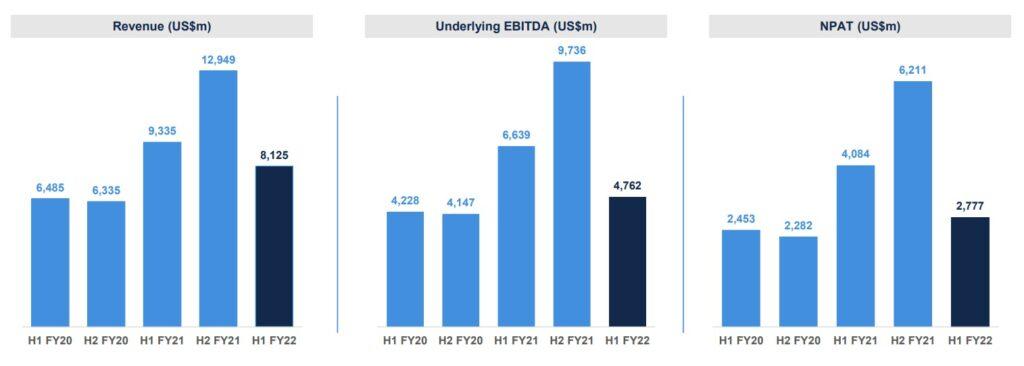

Therefore, there is a likelihood that the company’s best days are behind it, at least in the short term. Indeed, its revenue and profitability have started to drop. As shown below, revenue in H1 FY22 dropped to $8.12 billion from the previous $9.335 billion. Similarly, its EBITDA dropped from $6.6 billion to about $4.7 billion.

A key catalyst for Fortescue Metals is the falling value of the Australian dollar. The Aussie has fallen by over 15% from its highest point in 2021. Therefore, like with Burberry, the company will likely report positive AUD revenues.

Fortescue Metals share price forecast

The daily chart shows that the FMG share price found a strong resistance at around a$22.05 this year. A closer look shows that this price action was a triple top pattern whose chin was at a$16.87. It has now moved below the chin.

Most importantly, the stock is close to a death cross, which happens when the 200-day and 50-day moving averages. Therefore, there is a likelihood that the stock will continue falling as sellers target the key support at a$14.90.