Shell share price has been range-bound for the past few days as concerns over China’s demand heighten. As of the time of writing, the stock was trading 1.42% higher at 2394p. The stock has climbed more than 50% this year and 3% in the past week. The company’s total market cap is currently at £166.9 billion.

Oil Prices Outlook

Shell share price has been under intense pressure for the past few days amid uncertainty in the oil market. Earlier last week, OPEC+ announced that it would be sticking with oil output cuts and could apply further measures to balance the market as oil prices continued dropping.

Oil prices plunged in Tuesday’s early trade as concerns about China’s Covid-19 curbs weighed heavily on the market. Being the world’s top crude oil importer, a slowdown in China’s fuel demand has seen oil prices dive. Brent crude futures were down 0.5% earlier on Tuesday, to trade at $82.74 per barrel while US West Texas Intermediate (WTI) crude futures slipped 0.7% to trade at $76.73 per barrel.

Investors remain cautious ahead of a key meeting by OPEC and allies including Russia, on December 4. Analysts bet that the recent weakness in the market due to a slowdown in China’s demand will invite more supply cuts by the Organization of the Petroleum Exporting Countries (OPEC).

Investors are also assessing the impact of an imminent Western cap on Russian oil. The Group of Seven countries (G7) plans to launch a price cap on Russian crude sales from December 5. This will potentially do away with Moscow’s petroleum supplies in the market. The G7 has proposed a cap from within the range of $65 to $70.

Shell Share Price Forecast

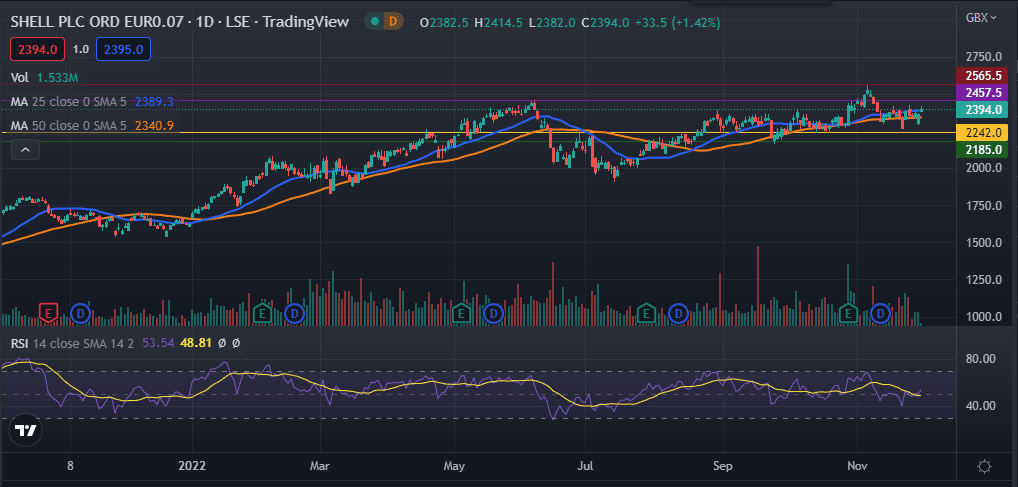

The daily chart shows that the Shell share price has been under intense pressure for the past few weeks. The stock hit an intraday high of 2414.5p before pulling back. It is trading along the 25-day moving average and has moved slightly above the 50-day moving average. Its Relative Strength Index (RSI) is neutral at 48.

Therefore, the Shell share price is likely to start a bearish run in the near term. If this happens, the next support levels to watch will be 2242p and 2185p. However, a move past the resistance level at 2457.5p will invalidate this bearish view.