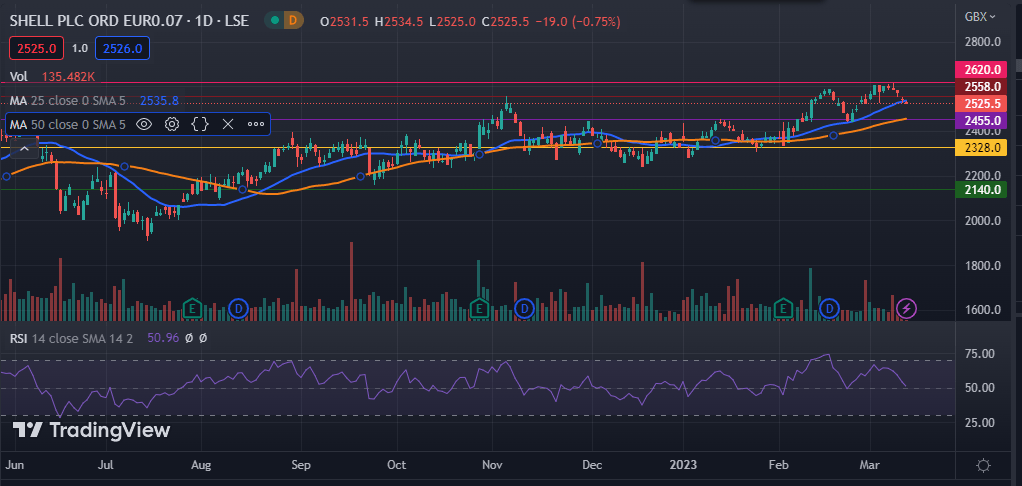

Shell share price has been on a steep decline for the past few days, staging a 2.25% drop in the past week. The SHEL stock is up by more than 7% in the year to date and currently sits 52% above its lowest level in 2022. Over the weekend, the stock was hovering slightly below the important level of 2558p.

Shell’s Outlook

Shell share price has been among the best-performing stocks in UK’s FTSE 100 index since the start of the new year. Earlier in February, Europe’s largest oil company by revenue posted a record profit of $40 billion in 2022, which was more than double what it recorded in the previous year.

The better-than-expected profits were boosted by soaring gas and oil prices following Russia’s invasion of Ukraine. Oil and gas giants reported bumper profits for 2022 against the backdrop of a jump in oil and gas prices. Sanctions by OPEC+ on Russian oil have seen the demand for oil and gas skyrocket.

Despite offering a great boost to the company’s performance, the vulnerability to the price of oil and gas tends to be one of the main risks in the business. The recent volatility in commodity prices has left stocks under pressure. Oil and gas prices were in the red last week amid concerns about potential further US interest rate hikes.

However, oil prices are likely to edge higher on Monday, wiping out their previous losses. At the time of writing, Brent crude futures were trading 0.56% higher at $83.22 per barrel. West Texas Intermediate (WTI) futures were higher by 0.56% at $77.11 per barrel. Therefore, volatile oil and gas prices remain the dominant feature when it comes to the stock’s outlook.

Shell Share Price Forecast

Shell share price has been under intense pressure for the past few days amid a slip in oil and gas prices. The stock is moving slightly above the 25-day and 50-day moving averages, while its Relative Strength Index (RSI) is in the neutral zone. It has also managed to remain above the 50-day and 200-day exponential moving averages.

As such, the Shell stock price is likely to stage a correction in the short term, moving past the resistance level at 2558p. If this happens, the next resistance level to watch will be at 2620p. On the other hand, a move below the key support at 2455p will invalidate the cautiously bullish thesis.