Rolls Royce share price has made a strong comeback in the past few weeks despite a gloomy economic outlook. The RR stock has gained nearly 5% in the past week and is up by 8.25% in its year-to-date price. At the time of writing, the stock was trading 1.19% higher at 103.80p.

RR’s Prospects

Rolls Royce Holdings Plc has been among the best performers in the FTSE 100 index since the new year. Rolls Royce is a British multinational aerospace and defence company. The firm designs, manufactures, and distributes power systems for aviation and other industries. Rolls Royce is the world’s second-largest maker of aircraft engines.

Rolls Royce share price has been on a stubborn but bullish trajectory for the past few weeks as the company continues to battle the damaging effects of the Covid-19 pandemic. The company has seen its shares slip by more than 56% in the past three years.

The aerospace giant has the tailwinds of a rebounding travel sector, especially with long-haul air travel. Even so, investors remain optimistic as China gradually opens and eases quarantine rules for international travel. This might increase flying hours this year, which might be good for Rolls Royce.

Investors have now shifted their focus to the new Chief Executive Officer, Tufan Erginbilgic, succeeding Warren East. The former BP Downstream Chief Executive has a strong reputation for strong turnarounds. Investors are looking to him to change the eye-watering state of the Rolls Royce business.

Rolls Royce Share Price

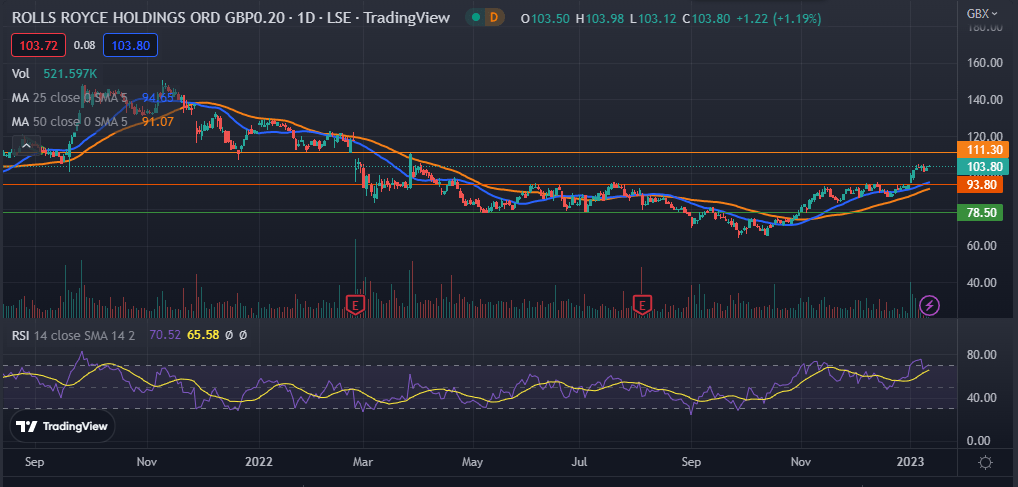

Rolls Royce share price has been hovering above its 9-month high for the past few days. The stock has managed to remain above the 25-day and 50-day moving averages. The RR stock is also moving above the 50-day and 200-day exponential moving averages. Its Relative Strength Index (RSI) has slipped five points below the overbought region.

Therefore, time will tell whether the bull or bear case for the RR stock price will be better grounded in the medium term. A move past the resistance at 111.30p will be bullish for the stock. On the other hand, a flip below the psychological level at 93.80p will invalidate the bullish view.