REA Group share price has been in a strong bearish trend in the past few months as investors price in a possibility of a cooling housing market in Australia. The stock is trading at $122, which is about 32% below the highest point in 2021. The firm has a market cap of about $16 billion, making it one of the biggest publicly traded firms in Australia.

Australia property market cooling

The Australian property market did well during the pandemic as the Reserve Bank of Australia (RBA) lowered interest rates to a record low. The sector also outperformed because of the increased savings as more people remained at home.

Recently, however, the situation is changing as interest rates have surged. The RBA has already delivered 135 basis rate hikes and hinted that it will continue. Most analysts expect that the bank will push them above the neutral point of 3% by end of the year. As such, most Australian homeowners have seen their mortgage costs rise by more than $500 this year.

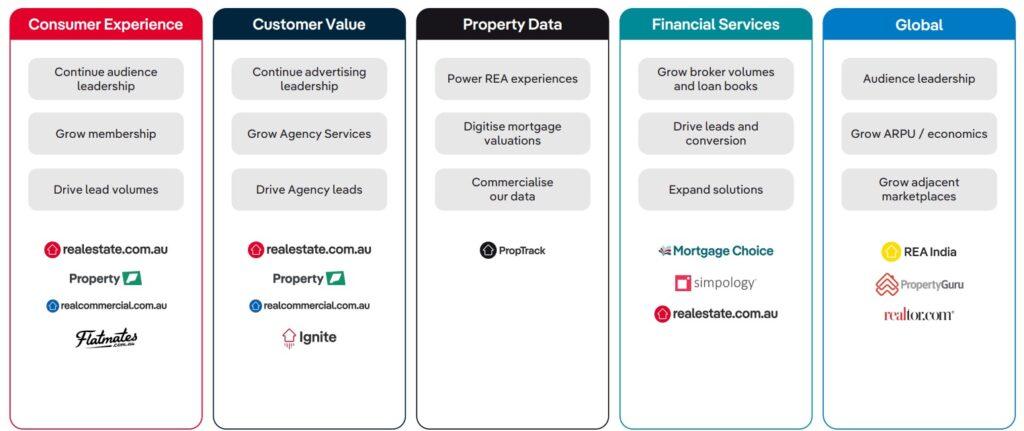

The changing dynamics explain why the REA Group shares have tumbled this year. For starters, REA is a technology company that operates the biggest housing portals in Australia. Its properties include realestate.com.au, realcommercial.com.au and flatmates.com.au. It also has stakes in companies like PropTiger.com and Realtor.com.

In addition to property portals, REA Group has businesses in other industries like agency services, agency marketplaces, property valuations, and mortgage booking among others.

Therefore, the REA stock price has declined as investors watch the property market. Data released recently shows that home prices have started to retreat in the past few months. Similarly, the volume of sales in key places like Sydney and Melbourne has dropped sharply recently.

REA is not the only company in the sector that has seen its stock collapse. For example, in the United States, shares of companies like Zillow, Opendoor, Compass, and Redfin have all plummeted this year. Also, other tech companies in Australia like Zip that did well during the pandemic have recoiled.

Is REA a good investment?

A potential catalyst for the company is its growing business in India, a country that is recovering at a faster pace than peers. It operates several websites under REA India that have a leading market share in the industry.

However, I believe that the company’s business will continue struggling as the RBA and Federal Reserve continue tightening. In the most recent results, the firm said the following. And note the emphasis:

“The Australian property market is very healthy. While we are seeing housing price moderation in some areas, the strong economic fundamentals will continue to support robust conditions beyond this quarter.”

The results showed that the company’s revenue rise from $656 million in the nine months to March 2021 to over $869 million in FY 22. Its free cash flow rose by 64% to $260 million. For the first quarter, the fiem’s revenue rose by 23% to $278 million while its free cash flow rose by 49% to $91 million.

REA Group share price forecast

The daily chart shows that the REA share price has been in a recovery mode in the past few weeks. In this period, the stock has recovered by about 32%. The stock has moved to the 38.2% Fibonacci Retracement level.

At the same time, the 25-day and 50-day moving averages have made a bullish crossover pattern. Therefore, there is a likelihood that the shares will continue rising as bulls target the key resistance level at $150.