The PageGroup share price has bounced back in the past few weeks as investors buy the dip. The PAGE stock is trading at 467p, which is about 21% above the lowest level this year. The stock is still about 30% below its 2021 high, bringing its total market cap to about £1.53 billion.

Why is the PAGE stock rebounding?

PageGroup is one of the biggest recruitment companies in the UK. The company provides general staffing and outsourcing solutions through its PageExecutive, Michael Page, and Page Personnel brands.

The company also offers solutions like Page Assessment, Page Consulting, and PageTalent among others. It has operations in 37 countries and serves customers like ABB, Allianz, Asos, and Halton Housing among others.

PageGroup share price jumped sharply in 2021 as demand for its hiring solutions rose as companies reopened and demand for workers rose. Indeed, the firm’s revenue jumped from over $1.7 billion in 2020 to over $2.2 billion in 2022. Its profit rose to over $160 million.

The stock then retreated sharply this year as the unemployment rate in most developed countries declined. Most investors were expecting that the company’s business will slowdown dramatically as demand waned.

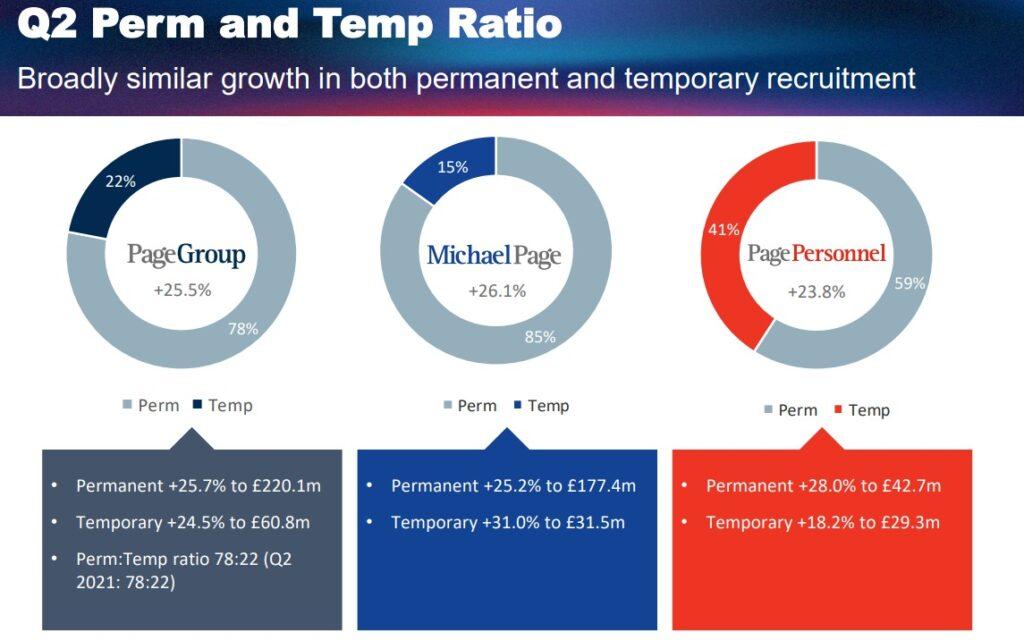

The PAGE share price has rebounded recently following the company’s strong results and forward guidance. The company’s gross profit rose from £219.8 million in Q2’21 to over £280 million. Its half-year profit rose from £404 million to over £539 million. As shown below, its three key divisions: PageGroup, Michael Page, and Page Personnel rose at a similar pace.

Is PageGroup a good buy?

The economy in its key countries like the UK, China, and US has changed dramatically in the past few months. In China, the recent lockdowns have caused the economy to weaken, with some companies like Evergrande in restructuring.

In Europe and the UK, the weaker euro and pound have led to a substantial change in how companies are hiring. The same is true with the US, where companies like Apple, Meta, Snap, Google, Microsoft, and Netflix have paused hiring. Others like Target and Better.com have started reducing their workforce.

Therefore, there is a likelihood that PageGroup’s demand has peaked and will continue slowing as central banks tightens. The European Central Bank decided to hike interest rates by 50 basis points this week. Indeed, the company’s CEO said:

“We are clearly aware of the heightened degree of macro-economic and political uncertainty that exists globally, particularly with regards to increasing inflation in the majority of the markets in which we operate. We are monitoring all KPIs in the business regularly, but to date, we have seen no significant changes apart from the usual seasonal movements.”

PageGroup share price forecast

The daily chart shows that the PAGE stock price has been in a strong bullish trend in the past few days. The stock managed to move above the descending trendline that is shown in black after its strong quarterly results.

Further, the 25-day and 50-day moving averages have made a bullish crossover pattern. Still, I believe that the stock will resume the downward trend and move below the important support level at 400p.