Ocado share price has been in a tailspin since its pandemic heyday in 2020. The British online grocery stock has crashed more than 25% in the past month and more than 38.50% in the year to date. The OCDO stock has been the worst-performing stock in the premier FTSE 100 index.

The End?

Ocado share price has been hovering around its lowest level since October 2022 for the past week. Investors have been turning their noses up at the Ocado stock price since its glory days during the pandemic. The online grocery store saw its shares skyrocket to a high of 2,895p in 2020 as the covid-19 lockdowns had customers ordering groceries online. However, with the end of lockdowns, people have got back to shopping in supermarkets.

Ocado Group Plc, an online grocer, and automated warehouses maker, has seen its market value crash over time and is now on track to be booted out of London’s top equity FTSE 100 index. High inflation levels and a decline in business after the pandemic have weighed on the stock which has seen its market value tumble. According to indicative results published by the London Stock Exchange Group Plc’s FTSE Russell on Tuesday, an engineering company part of the FTSE 250 index, IMI Plc could replace Ocado on the stock exchange.

Ocado’s shares have plunged more than 78% since 2021 amid a selloff in growth stocks. The slow and weakening demand for Ocado’s robotic warehouse technology saw the company post a £501 million pre-tax loss in the past financial year.

The removal of Ocado Plc from the FTSE 100 index is a blow to the UK’s goal of becoming a technology hub by 2030, following Brexit. The United Kingdom has been struggling to attract more tech companies to the stock market. The index has no major tech companies, with Halma Plc and software firm Sage Group Plc, having a market value of less than £10 billion. Final changes in the index will be announced later today before the close of the day’s trading.

Ocado Share Price Analysis

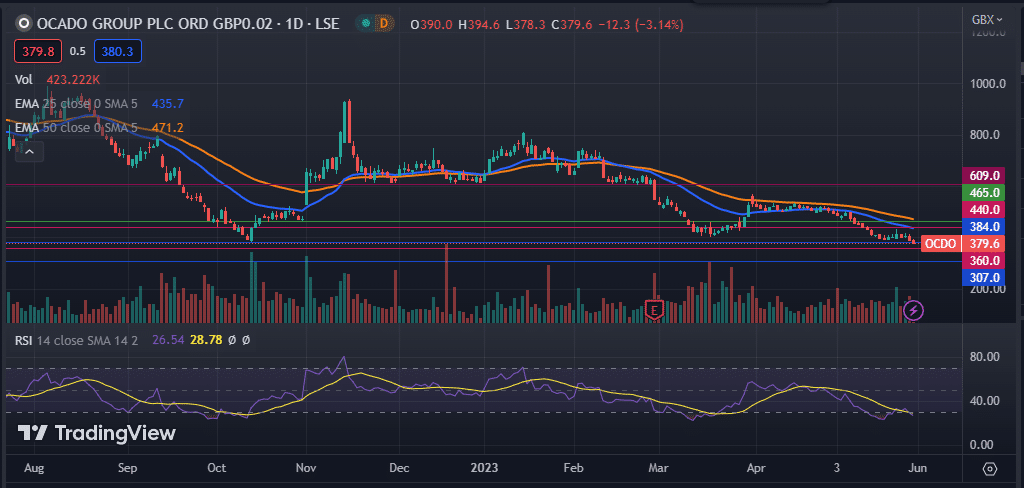

Ocado share price has been in a freefall since the start of the year as elevated inflation levels and slow demand for the company’s business weigh on the stock. The OCDO stock price has recorded the most losses this year in the FTSE 100 index.

On the daily chart, the stock has slipped below the 25-day, 50-day, and 100-day exponential moving averages, as well as the 50-day and 100-day simple moving averages. Its Relative Strength Index (RSI) has dropped below the signal line into the oversold region at 26.

Therefore, with the removal of the Ocado Group Plc from London’s blue chip FTSE 100 index, I expect the Ocado share price to plunge further. If this happens, the next support levels to watch will be 360p and 307p. On the other hand, a flip past the resistance level at 440p will invalidate my bearish thesis.