Lloyds share price has been trading in the red for the past few days as focus shifts to wall street earnings. The LLOY shares have slipped more than 10% from their highest level this year. Currently, the British bank has a total market cap of £32.289 billion. The shares have climbed 5% in the year to date.

Bank Earnings

Focus has now shifted to upcoming bank earnings by the biggest banks in the United States. Major banks such as Goldman Sachs, Morgan Stanley, and Bank of America are slated to release their earnings later this week. These banks are expected to post strong results, following a rise in bank deposits last month. Heavyweights, including JP Morgan Chase & Co, reaped windfalls from higher payments last week.

Most banking stocks slipped in March as contagion fears spread throughout the sector. The collapse of Signature Bank, Silvergate Capital, Silicon Valley Bank, and Credit Suisse left the banking sector jittery during the last month of the first quarter.

Lloyds share price will react to the earnings report by the Bank of America later this week due to the close correlation that exists in the sector. Lloyds Group Plc will not publish results this month, instead, it is expected to release its trading statement on May 3.

For the fourth quarter, Lloyds announced a pretax profit of £1.76 billion, as the company put aside £465 million for potential bad loans. Net interest margins rose by 3.22% in the fourth quarter off the back of higher interest rates. Even so, the company’s chief financial officer, William Chalmers, said that he expects net interest margins to drop over the year.

Lloyds Share Price Outlook

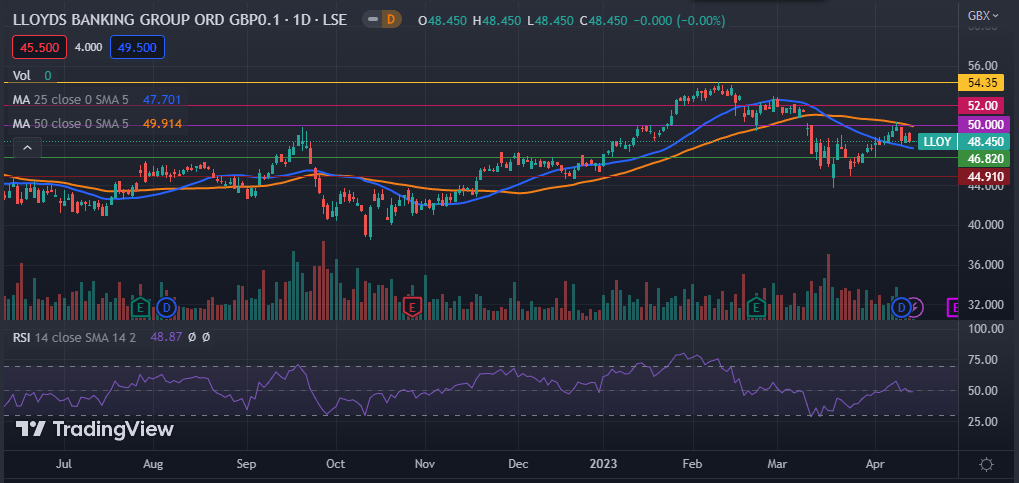

Lloyds share price has been moving lower for the past few days as investors focus on Wall Street earnings. On the daily chart, the LLOY stock has managed to remain above the 25-day moving average but has slipped below the 50-day moving average. Its Relative Strength Index (RSI) has moved below the neutral zone.

Therefore, Lloyds stock price is likely to experience volatility in the ensuing sessions as heavyweights publish their financial results. Sellers will be targeting the next support levels at 46.820p and 44.910p. However, a flip of the important resistance level at 50p will invalidate this view.