Lloyds share price has been in the red for the past week, plunging more than 5% over the period as investors shift focus to Congress’s vote on the US debt ceiling deal. The British banking stock was trading 1.71% lower at 45.215p during London’s trading session. LLOY’s total market cap has crashed to £29.52 billion amid increased market volatility.

Economic Concerns

Lloyds share price has been in a freefall for the past few days as US lawmakers prepare for the US debt ceiling vote. The banking stock has slipped 6.89% in the past month and is down by nearly 2% in the year to date. The LLOY stock remains 17% below its highest level this year in February as interest rates tailwinds pass.

The Bank of England (BoE) raised its key bank rate by 25 basis points earlier this month in line with market expectations, aiming to lower the elevated inflation rates. The Monetary Policy Committee (MPC) voted by a majority of 7-2 to increase interest rates to 4.50% in its May meeting.

All eyes are now on Congress ahead of the US debt ceiling vote. US President Joe Biden and House Speaker Kevin McCarthy finalized a budget agreement on Sunday, suspending the current US debt ceiling of $31.4 trillion to Jan 1, 2025. The suspension of the debt ceiling will allow the United States government to keep borrowing money and pay its bills on time. However, for the deal to go through, Congress must vote for the agreement before June 5 before the US government defaults.

Lloyds Share Price Outlook

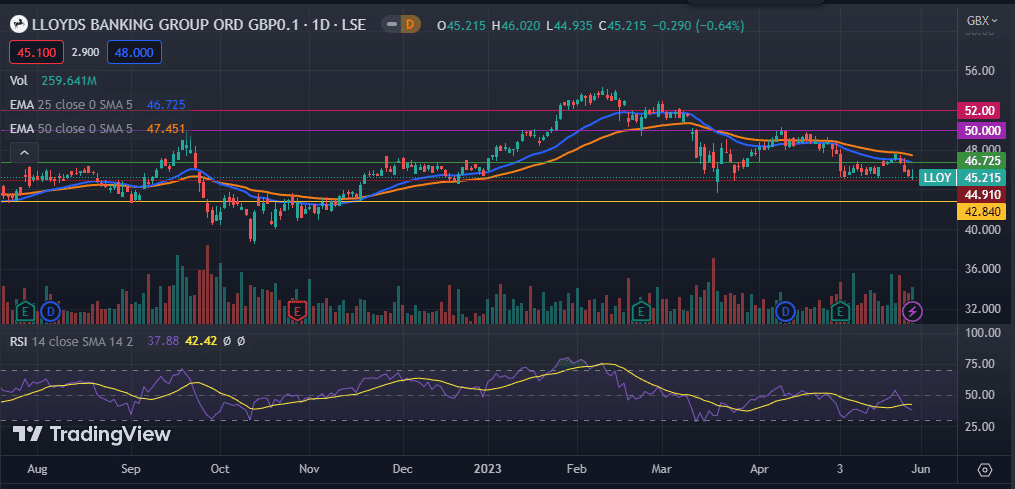

Lloyds share price has been under intense pressure for the past few days amid increased market volatility and the tension around the US debt ceiling deal. The LLOY stock price has been facing challenging quarters this year, slipping in the year to date. On the daily chart, the stock has moved below the 25-day and 50-day exponential moving averages, while its Relative Strength Index (RSI) dropped below the signal line to 37.

From the technicals, it is evident that the bears have gained full control of the stock’s price. As such, I expect Lloyds share price to fall further in the ensuing sessions. A move below the immediate support level at 44.910p will have bears eyeing the next support at 42.840p. Conversely, a move past the 25-day EMA at 46.725p will signal a price correction to the upside.