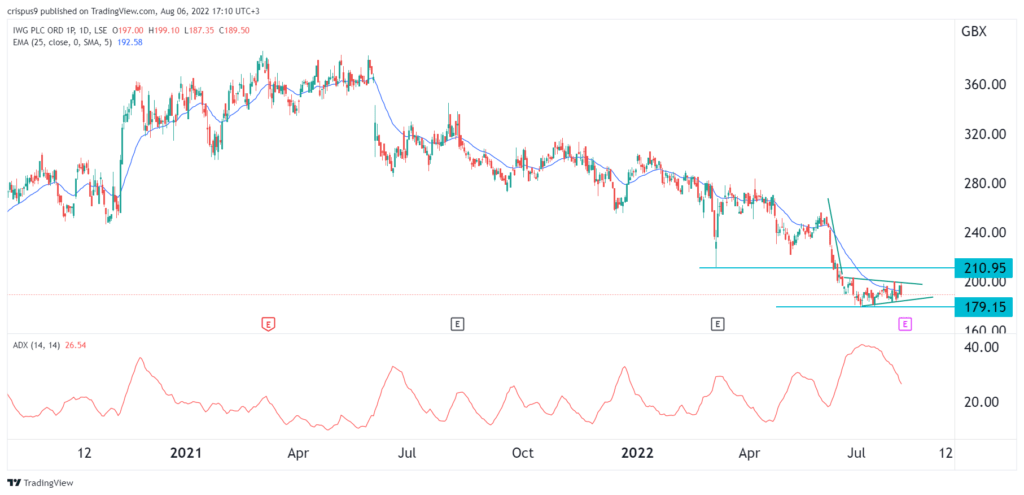

The IWG share price has tumbled in the past few months as concerns about the industry remain. The shares are trading at 189p, which is slightly above the year-to-date low of 179p. IWG has a total market cap of about 1.37 billion, making it one of the biggest players in its industry.

IWG earnings ahead

International Workspace Group (IWG) is a large company that provides solutions to many large and small companies. Some of its top clients are firms like Deloitte, Uber, and Microsoft. It also provides services to many freelancers and small companies.

IWG operates through several brands such as Regus, HQ, Signature, Spaces, and The ClubHouse among others. It does this because it targets different types of customers. Its other brands are Meetingo, Home to Work, and Rovva.

IWG operates in a highly competitive industry, with its biggest competitor being WeWork. The IWG share price declined sharply after WeWork published weak quarterly results. The firm said that its revenue rose by just 7% to $815 million. Its physical occupancy rate was 72% while its loss improved to $635 million.

IWG will publish its financial results on Monday next week. Analysts expect the results to show that the company’s revenue made a modest recovery as demand for hybrid business continued doing well. In a recent statement, the company said that demand for its services rose by 33% since January.

At the same time, the company said that it had managed to move back to profitability, helped by its regional sites. Therefore, some analysts believe that IWG is a good stock to buy in a period when demand for co-working space is rising.

Still, a major challenge for the company is that the British pound has fallen against the US dollar. As a result, the company will record slower revenue growth in sterling terms. At the same time, many tech companies like Wise that are leading consumers of co-working space have seen their cost of doing business rise. As such, many of them will likely reduce their demand of co-working spaces.

IWG share price forecast

The daily chart shows that the IWG stock price has been in a strong bearish trend in the past few months. Along the way, the stock has moved below the 25-day and 50-day moving averages. It has also formed a small bearish pennant pattern that is shown in green.

In price action analysis, this pattern is usually a bearish sign. The Average Directional Index (ADX) has moved to the lowest point since June. Therefore, the stock will likely continue falling as sellers target the next key support level at 150p.