IDS share price has been under immense pressure for the past few months as demand for its services continues to fall. The stock ended its previous trading session 2.67% lower at 225.8p, shedding Monday’s gains. The firm’s total market cap has crashed to £2.218 billion.

Rock Bottom?

IDS share price has been under intense pressure in recent months and could be headed lower amid the ongoing industrial action by its workers. The company has warned that the standoff with the Communication Workers Union (CWU) has seen the parcels and mail delivery company continue to lose about £1 million per day.

The CWU has been in talks with the IDS since November, negotiating a hike in its members’ wages. However, CWU said that the ongoing talks with the company have not been progressing as Royal Mail stands its ground.

Royal Mail’s Chief Executive Officer, Simon Thompson, said that the company’s current situation is untenable as the company continues to operate on losses. According to Thompson, the company will be forced to cut at least ten thousand jobs by the end of August this year, which will put a significant number of workers at risk of losing their livelihood.

IDS Share Price Forecast

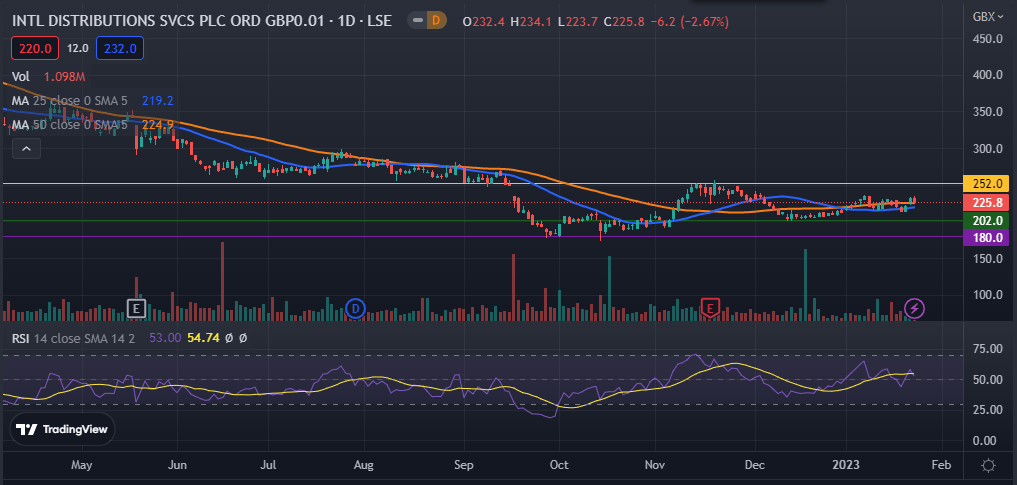

The daily chart shows that the IDS share price has been consolidating for the past few days. The stock is moving slightly above the 25-day and 50-day moving averages. Its Relative Strength Index (RSI) has slipped into the neutral zone. Therefore, I expect the IDS stock price to continue falling in the upcoming months as sellers eye the key support level at 202p. On the flip side, a move past the resistance level at 252p will invalidate my bearish thesis.