CBA share price ASX has staged a strong comeback in the past few months as the Australian economy remains resilient. It ended the week trading at A$105, which was about 20% above the lowest level this year. It has outperformed ANZ Bank, which has dropped by more than 13.90% this year and lagged NAB and Westpac.

Reserve Bank of Australia rate hikes

Commonwealth Bank is the biggest banking group in Australia with more than 17 million customers. The firm offers retail and business banking solutions in Australia and 14 other countries like New Zealand, China, UK, and Indonesia.

CBA provides services like home loans, credit cards, insurance, superannuation, and institutional banking. As Australia’s biggest bank, it is often seen as a barometer for the country’s economy. Like other countries, Australia is going through substantial challenges like drought and elevated inflation.

CommBank share price has bounced back because of the actions of the Reserve Bank of Australia (RBA). In a bid to fight inflation, the bank has hiked interest rate several times this year. The most recent rate hike happened this week when the bank hiked by 0.25% for the third straight meeting. It hinted that the end of the hiking cycle was nearing.

CBA, like other lenders, make more money in periods when central banks are hiking interest rates. This happens as the bank adjusts its interest rates to meet the minimum offered by the central bank.

However, the challenge with the current hiking cycle is that it is happening during a stagflation period. Stagflation happens when economic growth is accompanied by high inflation rate. As a result, it will not be surprise if the company’s provisions for bad debt rises. Still, these provisions will be limited because Australia has a persistent labor shortage.

CBA encouraging results

The most recent results showed that CommBank was doing well. Its Net Profit After Tax (NPAT) rose by 9% to $9.6 billion in the financial year. Its operating income rose by 3% to $24 billion.

By segment, its retail banking revenue rose to $4.9 billion while its business banking, institutional banking and markets, and New Zealand had a NPAT of $3 billion, $1 billion, and $1.2 billion, respectively. The bank has a healthy 11.5% CET1 ratio.

CBA share price will likely continue rising in 2023 as the company’s profitability rises. It has already hiked its dividend to $3.85 per share and analysts expect that its dividend payouts will continue rising.

Another likely catalyst for CommonWealth Bank stock price is Australia’s relationship with China. While still a long shot, there is a likelihood that the two countries will see better relationships in 2023. If this happens, it can boost Australia’s economy.

CBA share price ASX forecast

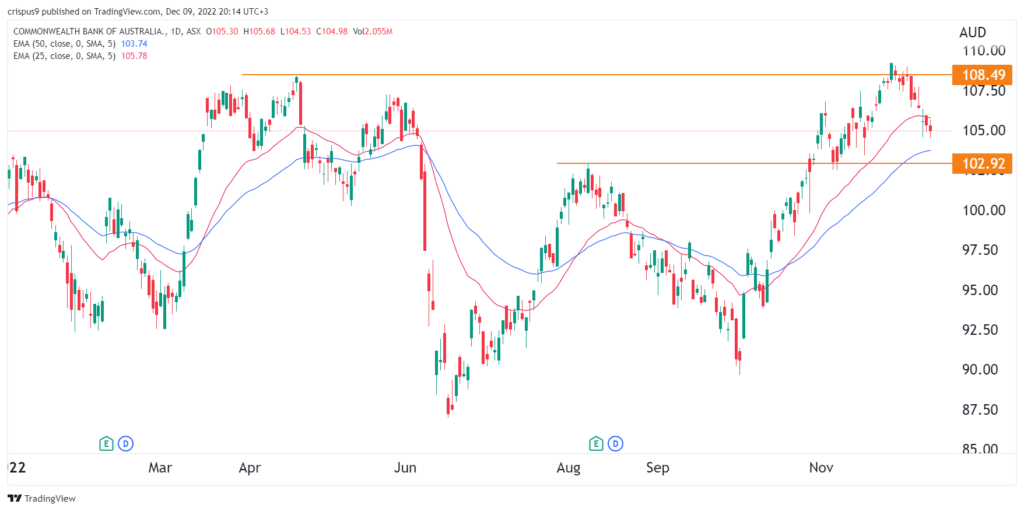

The daily chart shows that the CBA stock price asx has been in a strong bullish trend in the past few weeks. As it rose, it retested the important resistance level at $110, which was the highest point on April 21.

While the stock has pulled back, it remains slightly above the 50-day moving average and the crucial support at $102.92. The latter was the highest point on August 9. Therefore, I suspect that the shares will likely rebound in the coming weeks. If this happens, a move above the resistance point at $108 will mean that bulls have prevailed. That will push the stock to $120.

The main risk for the company is the world sinks to a recession in 2023. Signs are that will happen because of the inverted yield curve in the US and other countries. Another risk is that home prices in Australia will continue to fall in 2023.