Boohoo share price has been under intense pressure for the past few days after the firm reported a decline in its Christmas sales. Even so, the stock has staged a strong recovery in 2023, jumping 27.76% in its year-to-date price. At the time of writing, the BOO stock was trading 1.33% lower at 45.35p.

BOO’s Outlook

Boohoo share price has staged a strong comeback in the new year, jumping by more than 37% from its lowest level in December. However, the stock still faces various headwinds, including a challenging economic backdrop and a high cost of inflation.

Boohoo Group Plc reported an 11% year-on-year dip in its total revenue to £637.7 million in the four months to December 31, 2022. According to the company, full-year revenue for the fiscal year ending Feb 28, 2023, is expected to decline 12%. However, adjusted EBITDA is expected to remain in line with market expectations.

The company’s Christmas sales fell amid a decline in demand. Boohoo makes most of its sales in the UK and the US, which suffered the biggest hit year on year.

Boohoo Chief Executive Officer John Lyttle said he expected cost inflation to begin moderating in the second half of the year. The company has responded to the high inflation cost by cutting costs, including the closure of one of its UK warehouses. The fast-fashion retailer has also cut down inventory by 27%.

Boohoo Share Price Forecast

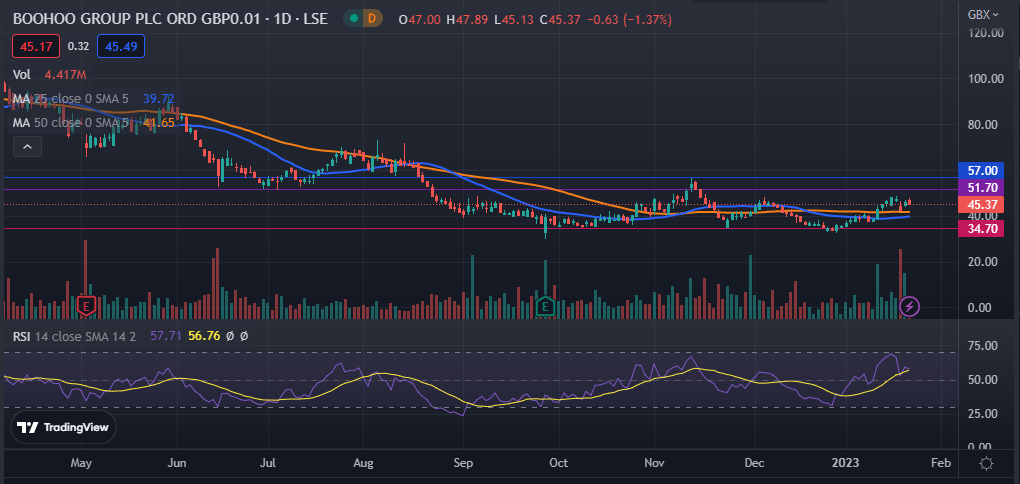

The daily chart shows that the Boohoo share price has been on a strong but slow uptrend since the start of the year. The stock hit an intraday high of 47.89p before pulling back further. The BOO stock has jumped above the 25-day and 50-day moving averages while its Relative Strength Index (RSI) has continued ticking higher.

Therefore, the BOO stock price is likely to have a bullish breakout in 2023 as buyers target the key resistance at 57p.