BHP share price has been under intense pressure for the past few weeks amid the global financial crisis. The Australian stock has dipped by nearly 4% in the past week, while its year-to-date price fell further by 5.57%. The company’s market cap has inched lower to A$217.59 billion.

BHP Outlook

BHP Group Ltd is a multinational resources company that engages in the exploration, development, production, and processing of iron ore, coal, copper, nickel, and more. The BHP share price has dipped below $44, its lowest level since November 2022. The company’s shares have plunged by more than 10% since the start of March.

There has been considerable volatility in the market over the past few weeks amid the recent banking fiasco. Investors have been digesting the recent crisis in the banking sector, with two mid-tier banks in the United States being taken over by authorities. Less global demand in the economy could mean less demand for commodities, hurting the profits of mining shares such as BHP.

Over the last three years, BHP has generated more than 120% of returns on the back of high commodity prices and the company’s high production prices. However, in the last month, the stock has been on a steep decline as falling commodity prices and rising costs continue to weigh on the company’s operations.

Australian miner, New Hope, recently announced that it would be looking to buy some coal assets being dumped by BHP. New Hope will be assessing the Daunia and Blackwater mines that BHP announced they would be selling. New Hope’s CEO Rob Bishop stated that,

“Global underinvestment in new mines will continue to support prices, as demand for coal will continue to outstrip supply well past 2050.”

BHP Share Price Analysis

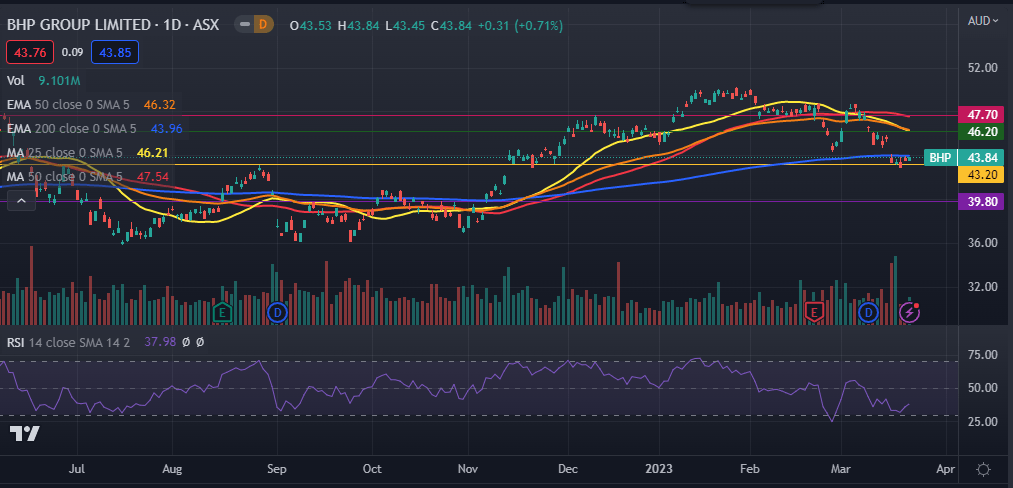

BHP share price has been on a steep downward trajectory for the past month, as seen in the daily chart below. The stock has moved below the 25-day and 50-day moving averages, as well as the 50-day and 200-day exponential moving averages. Its Relative Strength Index (RSI) is a few points above the oversold region.

Therefore, the BHP stock price is likely to continue falling in the short term amid a fall in commodity prices. A move below $43.20 will have bears pushing the price lower to the next support level at $39.80. However, a move past the key level of $46.20 will invalidate the bearish view.