BHP share price ASX is stuck near its all-time high even as the commodity supercycle nears its end. The stock was trading at $47.50 on Friday, a few points below its all-time high of 47.90. It has surged by more than 32% from its lowest level this year. The stock has outperformed key peers like Glencore and Rio Tinto.

China reopening hopes

BHP is the biggest miner in the world. It mines and sells important metals like iron ore, copper, nickel, coal, and potash. The stock has done well this year because demand for these metals has been elevated this year. Demand for nickel has risen sharply this year as more auto companies move to EV manufacturing.

Coal, on the other hand, has done well as countries in Europe restart their coal plant following Russia’s invasion of Ukraine. While some metal prices like iron ore and copper have lagged, their volume have done well.

BHP share price has risen recently because of hopes that China will reopen in 2023. Facing unprecedented protests, Beijing has started easing some Covid-19 restrictions. Analysts expect that China’s economy will bounce back by 5% in 2023. China is an important market for BHP’s products. As a result, iron ore price has jumped to the highest level in six months.

BHP dividend and performance

Analysts expect that BHP will continue doing well in 2023 although there are concerns about the commodity supercycle. The most recent results showed that BHP generated $34 billion in profit in the last financial year while its EBITDA rose to $40.6 billion. Its net operating cash flow soared.

As a result, the company boosted its returns to shareholders. It hiked its dividend and buybacks to more than $36 billion. Its petroleum business merged with Woodside Energy, leading to special dividend of $16 billion.

BHP Group has a strong dividend profile. Its forward dividend yield stands at 11% while its trailing twelve-month yield stands at 9,73%. These yields are supported by the string payout ratio of 37.56%. In the past five years, BHP has had a dividend growth rate (CAGR) of 33%, which is higher than its top competitors like Rio Tinto and Anglo American.

BHP is not cheap for obvious reasons. The stock trades at a forward PE ratio of 12.65x, while most mining stocks have multiples of less than 10. Its EV to EBITDA of 5.46 is higher than that of Rio Tinto, Glencore, and Anglo American.

Still, the rising demand for coal, nickel, copper, and iron ore will likely support the BHP share price ASX. This explains why analysts are bullish about the BHP stock. Analysts at Bank of America, Deutsche Bank, Barclays, and JP Morgan are all bullish the stock. The only one bearish is from Goldman Sachs.

BHP share price ASX forecast

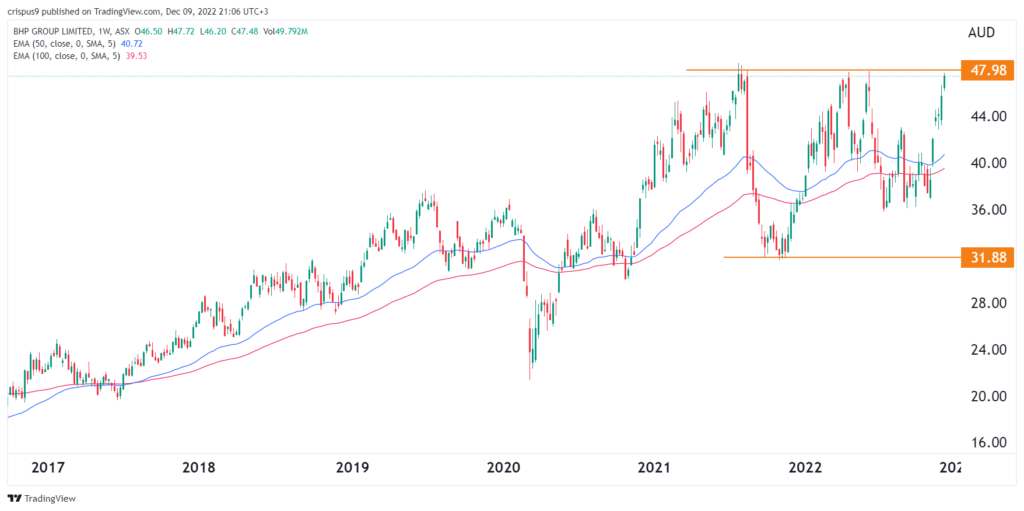

A closer look at the BHP share price history shows that it has been in a strong bullish trend in the past few years. Along the way, the stock has jumped above all moving averages, which is a good sign.

Now, however, it appears like the stock is at a crossroads since it sits at an important resistance level. It has formed what looks like a triple-top pattern. In price action analysis, this pattern is usually a bearish sign. The neckline of the pattern is at $31.88, which is about 33% below the current level.

Therefore, in my view, the outlook for the BHP stock price is neutral for now. A volume-supported move above the resistance at $47.88 will mean that the triple-top pattern has been invalidated. Such a move will see the shares keep rising. The alternative scenario is where it drops to the neckline.