AMD stock price has fallen back to earth as investors remain concerned about the company’s growth and valuation. Advanced Micro Devices shares are trading at $77, which is about 53% below its all-time high. It is now sitting at the lowest level since May last year while its total market cap has crashed to $124 billion.

AMD market share growth

AMD is a giant technology company that designs products that are widely used in most industries. The company focuses on computer chips that you can find in desktop computers and laptops and data centers.

AMD has been in a strong growth in the past few years. Most of this growth is attributed to the actions of Lisa Su, the company’s CEO, who transitioned it from a small chip maker to a global juggernaut.

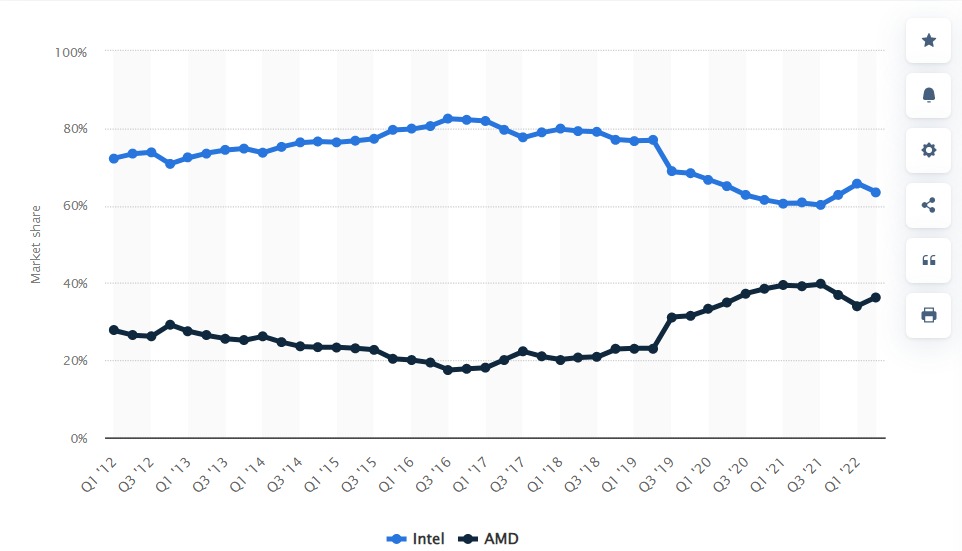

In the past few years, AMD has released products that are significantly more advanced than those offered by peers like Intel. For example, its AMD Ryzen 5000 processors are based on the 7nm architecture. Intel has struggled to launch similar chips and delayed them for years. As shown below, AMD has been narrowing Intel’s market share for a while.

AMD has also grown through acquisitions. The most important buyout was Xilinx for $49 billion. Xilinx is a major chip manufacturer that focuses on FPGA. These are chips that are programmable after manufacture.

Why are AMD shares crashing?

There are several reasons why the AMD stock price has crashed this year. First, the decline is thematic considering that other semiconductor stocks like Qualcomm, Intel, and Nvidia have all retreated. The closely watched iShares Semiconductor ETF (SOXX) has dropped by more than 30% from its highest point last year. It has fallen by 30% YTD.

Second, there are concerns about the company’s growth due to the soaring inflation. Analysts expect that companies and individuals will delay their hardware purchases as they wait for prices to drop.

Like Wayfair, AMD has become a reopening stock. As you recall, the Covid lockdowns pushed more people indoors. As a result, demand for video games and work-from-home computers rose sharply. Now, with the world moving back to normal, analysts expect that AMD’s demand will soften. In a note, analysts at Northlands said:

“We scrubbed our AMD numbers and lower our [2023] estimates to comprehend a global economic slowdown that will likely impact PC CPUs, GPUs, game consoles, and XLNX.”

Further, AMD is struggled because of the high cost of doing business. It is paying its staff more while the ongoing logistics challenges will likely hurt demand.

The outlook for chip stocks worsened when Micron warned about its business. The Micron stock price crashed by 8% after the company warned that its business was facing significant challenges. The CEO warned that its demand had weakened recently and that the firm would work to moderate growth.

Is AMD a good buy?

Now, with the AMD share price off by over 50% from its all-time high, investors are wondering whether it is a good value stock to buy. Others worry about whether it is a value trap.

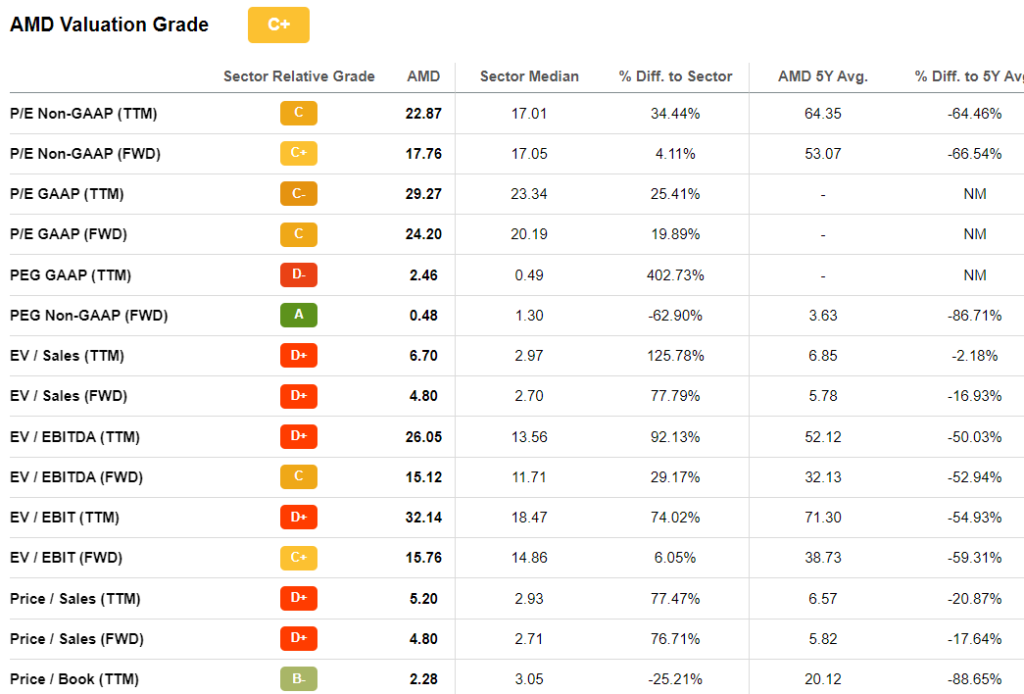

To answer this question, we need to first look at AMD’s valuation. This is a relatively difficult thing to do because of the recent acquisition of Xilinx. Still, using data provided by SeekingAlpha,

AMD has a forward price-to-earnings ratio of 24.20, which is higher than the sector median of 20.9. It also trades at a forward EV-to-sales ratio of 4.80, which is also higher than the sector median as shown below.

Still, AMD has always been an overvalued company because of its strong growth and market share. As such, these multiples are a significant discount from their historic highs. Also, it is worth noting that many companies being compared are traditional firms that have slow growth.

Fundamentally, AMD’s business will likely continue doing well in the long term as the world becomes more digital. AMD’s products will have an important role in this universe.

AMD stock price Prediction

The daily chart shows that the AMD share price has been in a strong bearish trend in the past few months. It has fallen in the past three straight days and there is a possibility that this sell-off will continue after the latest Micron earnings.

The stock has formed a descending channel and is now at its lower side. It also remains below the 25-day and 50-day moving averages while the Relative Strength Index (RSI) is approaching its overbought level.

Therefore, in my view, you should not try to catch a falling knife. The bearish trend will likely continue in the coming months as bears target the key support at $65. In the long-term, the stock will likely bounce back as investors buy the dip.