Ethereum price has been on a strong downward trend for the past few weeks, crashing more than 14%. The ETH coin has slipped more than 70% since the start of the year and 45% in the past 6 months. The coin’s market cap has dropped by 4% in the last 24 hours. The total volume of ETH traded over the last day is up by 14%.

ETH Outlook

Ethereum has been among the worst-performing cryptocurrencies this week. Other poor-performing altcoins include XRP, Cardano, Dogecoin, Polygon, Polkadot, Shiba Inu, and Solana, among others. According to data by CoinMarketCap, the global crypto market cap, and the total crypto market volume have slipped over the last day.

Ethereum price has been on a strong bearish trajectory since November and shows no signs to stop it. Uncertainty in the crypto market has continued rising on the back of rumors about Genesis’ bankruptcy and FTX exploiter offloading his ETH in millions.

According to a report by Bloomberg, Genesis Global Trading mentioned bankruptcy as a potential option as it seeks fresh capital. The cryptocurrency lender was forced to halt withdrawals in the wake of the collapse of the crypto exchange FTX. This sent the Bitcoin price to a fresh two-year low of $15,480. However, Genesis said that it has no immediate plans to file for bankruptcy.

Ethereum’s underperformance has also been linked to the ongoing debacle ignited by the collapse of FTX. There have been speculations about the $600 million drained from FTX a couple of weeks ago.

$72 million in Bitcoin and Ethereum was moved through the Ren BTC gateway by an individual referred to as an “FTX drainer”. The address associated with the breach holds over 200,000 ETH (worth more than $223 million). This suggests that the Ethereum price might experience strong downward pressure in the coming weeks.

Ethereum Price Outlook

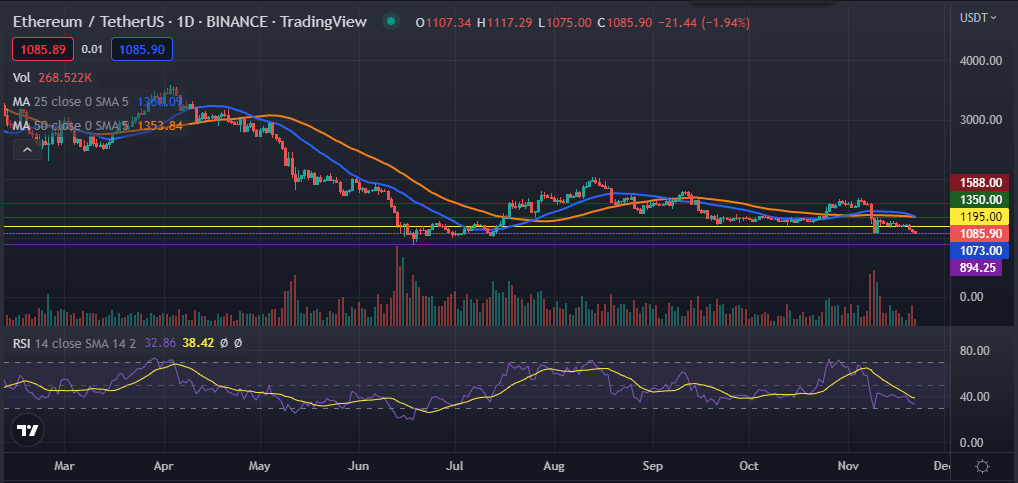

The daily chart shows that the Ethereum price has been on a consistent bearish trajectory for the past few weeks. It has managed to move below the 25-day and 50-day moving averages. Its Relative Strength Index is weak at 38. At the time of writing, it was trading 2% lower at $1084.87 after hitting an intraday high of $1117.29.

A resurgence of buying pressure could push the Ethereum price to $1,195. If this happens, ETH could revisit the crucial resistance levels at $1,290 and $1,350. However, a continued bear run will have the next support at $1073.