Ethereum price has taken a significant hit for the past few days, plunging more than 12% in the past week after tapping a 10-month high of $2,141.54 earlier this month. The altcoin was trading slightly lower at $1,860.42 at the time of writing. ETH’s total market cap was up by 2.41% at $224 billion at press time, while the total volume of the coin traded climbed by 12%.

Fundamentals

The crypto sector has been under intense pressure for the past few days as markets price in a 76% chance of the Fed hiking its interest rates in May. However, the global crypto market was in the green earlier on Wednesday as investors remain wary of the banking sector outlook and a potential global recession.

The global crypto market cap has increased by 3% over the last day to $1.18 trillion, while the total crypto market volume inched 12.81% higher. Bitcoin’s dominance has also increased slightly to 46.41%. Bitcoin, the largest cryptocurrency by market cap, has also inched slightly higher but remains below the crucial $28,500 level.

Markets have been in jitters for the past few days amid disappointing Wall Street earnings, which have reignited banking fears. First Republic Bank shares plunged more than 50% on Tuesday after the bank reported a more than $100 million dip in deposits in the first quarter. Cryptocurrencies tend to thrive in an environment where the banking sector is underperforming as most investors shift from traditional financial institutions to digital assets.

The US Federal Reserve has predicted a recession as the IMF predicts a sluggish global economy. The Fed suggested that the banking crisis will likely push the economy into a recession this year. Also weighing on the economic sentiment, the US Conference Board Consumer Confidence Index fell in April to 101.3, down from 104 in March and below analysts’ estimates of 103.0.

The Expectations Index -measuring customers’ short-term outlook for income, business, and labor market conditions- fell to 68.1 in March, down from 74.0. The Expectations Index has been below the important level of 80- the level associated with a recession within the next year- every month since February 2022, with an exception in December.

Focus is now on the Federal Reserve’s two-day policy meeting slated for next week as investors look for hints about the Fed’s next policy moves. A 25-basis point interest rate hike is widely anticipated. Higher interest rates tend to pose a bearish environment for risk assets such as stocks and cryptocurrencies, especially heavyweights such as Bitcoin and Ethereum. As such, a hawkish Fed will likely see the Ethereum price experience a pullback.

Ethereum Price Outlook

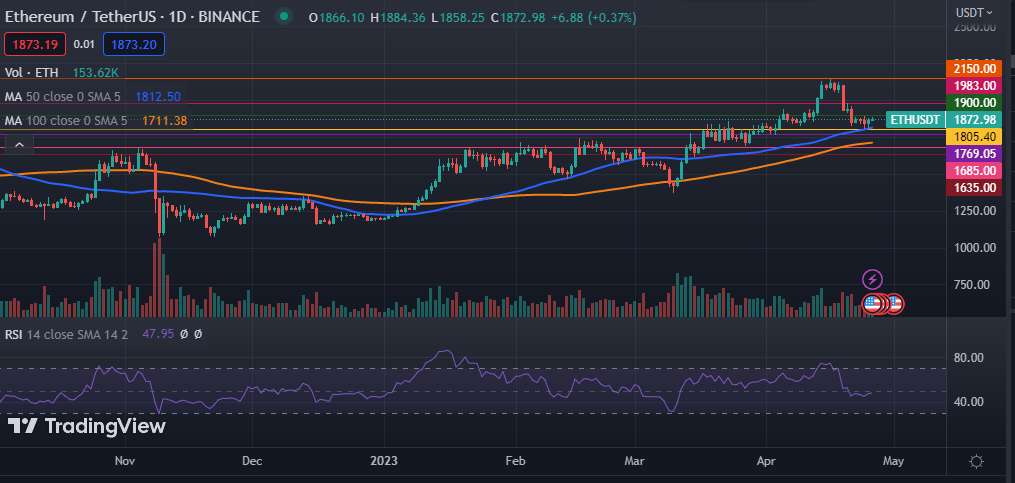

The ETH/USD pair has started an upside correction from $1,800 as highlighted on the daily chart. The Ethereum price has been bene hovering above the crucial $1,850 level for the past few days. The altcoin has managed to remain above the 50-day and 100-day moving averages, as well as the 50-day and 200-day exponential moving averages (EMAs).

The altcoin has also retained its position above the 50-day and 100-day simple moving averages (SMAs). The Moving Average Convergence Divergence (MACD) indicator is bearish, while ETH’s Relative Strength Index (RSI) remains below the neutral zone.

A move past the resistance level at $1,900 will push the Ethereum price higher as buyers eye the next resistance levels at $1,983 and $2,150. On the flipside, a move below the crucial support at $1,805.40 will invalidate this bullish thesis.