BNB price has crashed more than 11% in the past few days on the back of the legal battle between the SEC and Binance. The Binance Coin price has slipped below the critical level of $300 and currently hovers 21% below its highest level this year. The asset’s total market cap has slipped by more than 10% in the past three days to $43 billion, down from $50 billion.

Binance vs SEC

BNB price has been in a sharp decline for the past few days as its founder, Binance, faces a lawsuit against the US Securities and Exchange Commission (SEC). The digital currency plunged more than 10% on Monday, marking its biggest one-day drop so far this year. BNB’s value has dipped by more than 11% in the past week and 14% over the past month.

Binance, the largest cryptocurrency exchange in the world, was accused of mishandling customers’ funds and running illegal operations in the United States. The US financial watchdog named Binance’s CEO, Changpeng Zhao, as the defendant in the lawsuit filed on Monday in the Federal District Court in Washington.

According to the Wall Street regulator, Binance used a Zhao-owned company called Sigma Chain to manipulate its trade by inflating its trading volume. According to the SEC, while Binance publicly claimed that Binance US was an independent trading platform for US investors, the site was secretly controlled by Zhao.

Binance has faced a slew of lawsuits in recent months as the global crypto market battled the crypto winter. Earlier in March, the Commodity Futures Trading Commission (CFTC) filed a complaint against Binance, alleging that Binance and Changpeng Zhao offered unregistered crypto futures and assets to US residents.

Binance is not the only crypto exchange platform facing allegations from the US authorities. Crypto exchange, Coinbase, was also accused on Tuesday of putting customers at risk by operating as an “unregistered broker, exchange, and clearing agency”. The SEC appears bent on a wider crypto crackdown, buoyed by the collapse of crypto exchange FTX, founded by Sam Bankman-Fried. Bankman-Fried is currently being charged with eight criminal counts including, wire fraud on customers and lenders, money laundering, and violating U.S. campaign finance laws.

With the global crypto crackdown, the crypto market is likely to experience increased volatility. The outcome of the lawsuit against Binance will sway the BNB price in the ensuing sessions.

BNB Price Technical Analysis

BNB price has been in the red for three consecutive days as its founder, Binance, faces regulatory complaints. The asset has slipped more than 11% in the past few days but remains 12.55% higher in the year to date. Is it time to sell?

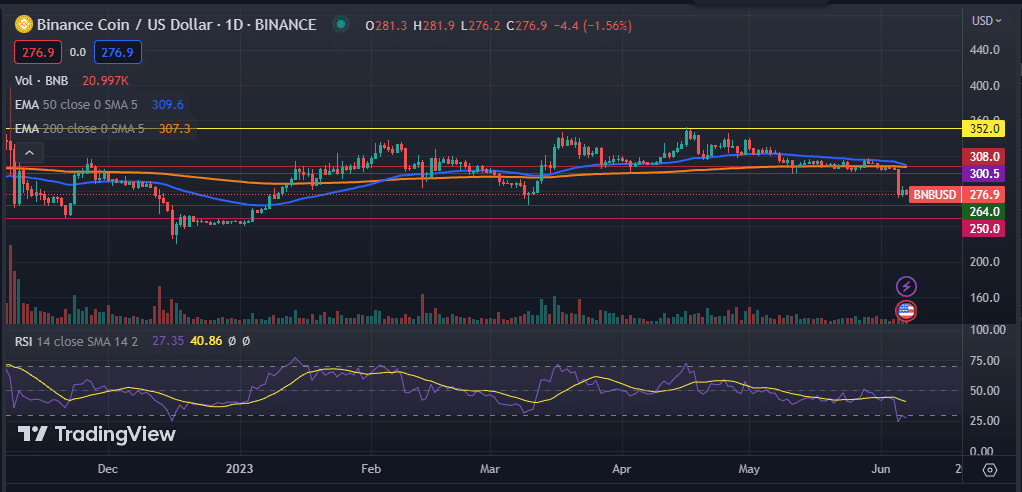

The daily chart shows that the Binance coin has moved below the 50-day and 200-day exponential moving averages, as well as the 50-day and 100-day moving averages. The asset’s price is facing a potential death cross, which happens when the 50-day EMA crosses below the 200-day EMA. Its Relative Strength Index (RSI) has crashed into the oversold region, suggesting an increase in selling pressure.

Consequently, I expect the BNB price to pull back further in the ensuing sessions as sellers eye the next support zone of $264. A move below this level will have bears eyeing the critical level of $250. Conversely, a move past the important level of $300.5 will give bulls enough momentum to push the price higher above the 200-day EMA at $308.