Avalanche price suggests a bullish sentiment amid a significant recovery in price levels following a substantial loss. The bulls have a favorable opportunity to stage a strong comeback, surpassing the crucial $15 level. Avalanche has been under intense pressure over the past month, characterized by a dominant bearish outlook, consistently driving AVAX’s prices lower.

Fundamental Analysis

Avalanche price has been hinting at recovery over the past 25 hours as the bulls market gradually retains its strength, pushing the price higher. The coin’s total market cap has also improved in the last day to $4.9 billion, ranking it the 16th largest cryptocurrency after Shiba Inu. The asset’s total volume has also improved over the same period.

One of the reasons behind the recovery of the Avalanche price is the recent trend reversal in the global crypto market cap. According to Coinmarketcap, the global crypto market cap has jumped 1.32% over the past 24 hours to $1.14 trillion, while the total crypto market volume increased by more than 21%.

Secondly, Bitcoin’s price ticked higher over the last day, clearing the $27,000 level after Hong Kong’s securities regulator announced that it would allow retail trading of certain crypto assets on registered trading platforms starting next month. The new guidelines are part of broader efforts by Hong Kong to become a global crypto hub.

Hong Kong’s ambitions toward the crypto industry are in sharp contrast with China, which banned cryptocurrency trading in 2021. The move also comes at a time when the regulatory stance towards crypto in the US remains hostile since the collapse of Sam-Bankman Fried’s FTX platform.

However, concerns about the US Federal Reserve’s monetary policy outlook have continued to outweigh markets. With most US policymakers sounding a preference for higher interest rates, markets have ramped up bets that the Fed funds rate will remain elevated.

Avalanche Price Outlook

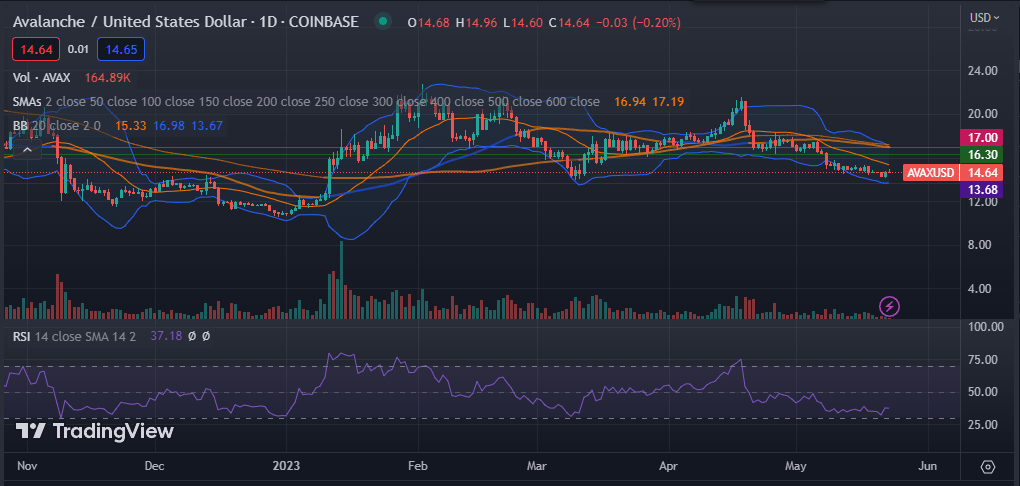

Avalanche price was gaining on Tuesday, building on Monday’s gains amid hopes that the surging interest in the network might help sustain its uptrend. The digital asset is moving below the 50-day and 200-day exponential moving averages, as well as the 50-day and 100-day simple moving averages, as highlighted on the daily chart.

Its Relative Strength Index (RSI) is currently at 37, while the Moving Average Convergence Divergence (MACD) indicator is breaking above its signal line and showing convergence, hinting at a potential trend reversal to the upside. The expanded Bollinger Bands show an increase in market volatility, with the upper band at $17 and the lower band at $13.68.

Seeing that the asset has continued to trade below the 50-day and 100-day SMAs, the Avalanche price is likely to fall further in the immediate term, before experiencing a correction. As such, the lower Bollinger Band serves as a support level for the AVAX’s price. On the other hand, a move past the 50-day EMA at $16.30 will invalidate this bearish thesis.