AirSwap price has staged a strong rebound in the past few days as demand for the coin jumps. AST rose to an intraday high of $0.1243, which was the highest point since May 5th of this year. At its peak, the token was up by 170% from its lowest level this month. It has a total market valuation of over $19 million, making it a relatively small DeFi token.

What is AirSwap?

The Decentralized Finance (DeFi) industry has had a relatively rough time in the past few months. It has seen its total value locked (TVL) from over $250 billion to less than $75 billion. As a result, there have been concerns about whether DeFi is dead.

AirSwap is a DeFi platform that uses Ethereum’s technology. It is a peer-to-peer platform that enables people to easily swap their tokens while saving money. The platform was designed to solve the challenge that exists among DeFi protocols that use order books to handle transactions. For example, there is the challenge of the non-scalability of blockchain order books.

AirSwap solves the challenge by introducing the concept of peer-to-peer concept. According to the white paper, P2P is a highly scalable way of handling transactions. It is also a private method of dealing with DeFi and it creates a fair approach.

AirSwap has three key players. There is the maker, taker, and the contract. Taker receives an order while the maker replies with an order. Taker calls fill orders on the smart contracts.

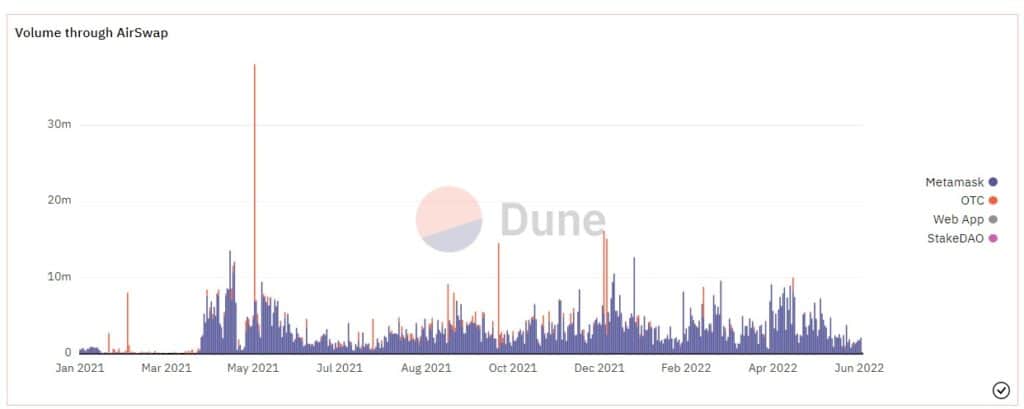

According to Dune Analytics, the cumulative all-ime volume of transactions in AirSwap surged to more than $1.7 billion. The number of swaps on Ethereum rose to over 207k while the total fees collected is over $1.7 million. AirSwap has also had some sizable volume in its BNB and Polygon platforms. The chart below shows the cumulative volume through AirSwap.

Why is AST soaring?

There are several reasons why AirSwap price has been soaring recently. First, there are signs that the volume in the network is stable, even though it has dropped from its all-time high. In a recent Tweet, the developers moted that they handled the biggest swap on record. A trader made a $360k USDT/ETH swap.

Second, AST price is rising as investors buy the dip. These investors believe that the platform has a good future in the DeFi industry. Other DeFi tokens like COMP, Spell Token, and AAVE have been soaring recently.

Finally, the coin is rising after Coinbase announced that it would add support for the coin. The other tokens that the company added are Monavale, Metis DAO, and Chain.

AirSwap price prediction

The four-hour chart shows that the AST price has been crawling back after Coinbase listed the coin. Along the way, the coin managed to move above the key resistance level at $0.0965, which was the highest level on May 31st.

A closer look shows that the coin has jumped above the 25-day and 50-day moving averages (MA) while the Relative Strength Index (RSI) has been rising.

Therefore, with the coin forming a bullish flag, there is a likelihood that Airswap will keep rising as bulls target the key resistance at $0.15.