Silver price has remained under pressure as optimism over the US debt ceiling deal boost the dollar. In the ensuing sessions, Chinese economic data and US jobs data will shape the path for the dollar-priced asset.

Fundamentals

Optimism over the US debt ceiling deal has further boosted the dollar while weighing on silver price. Granted, even though both sides are in on the in-principle deal, it still needs approval by the Senate and Congress.

In the new week, investors will be eyeing crucial data from both China and the US. In particular, Chinese manufacturing and non-manufacturing PMIs are set for release on Wednesday. This comes amid the persistent concerns over the recovery of the country’s economy from the COVID-19 pandemic.

In addition to being a precious metal, silver is also a major industrial metal. Seeing that China is the leading consumer of industrial metals, the gloomy economic outlook continues to weigh on silver price.

At the same time, the US jobs data due on Friday are also on investors’ minds. Strong numbers may hint at additional pressure on the Fed. If that happens, silver price will likely record further decline as the US dollar strengthens.

Silver price prediction

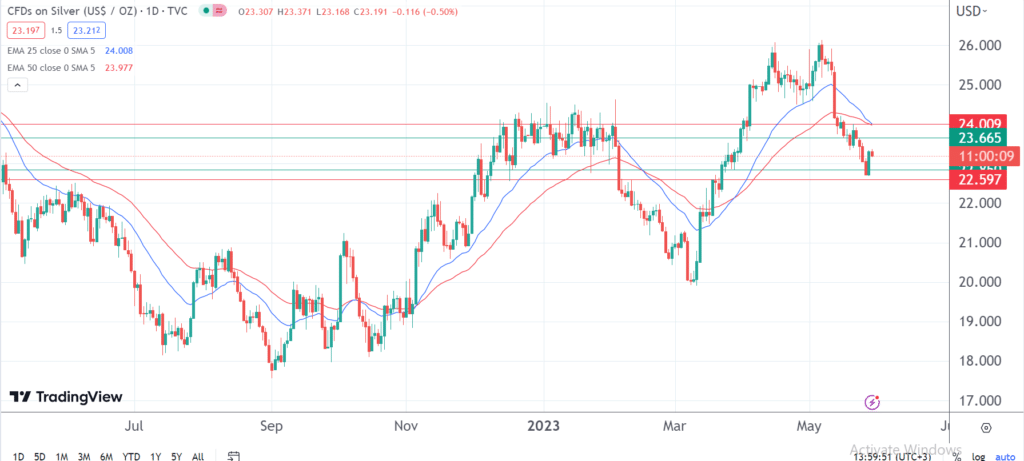

Silver price has been on a downtrend for over three weeks now; dropping by over 10% during this period. Notably, it has started the new week on its back foot even after the significant rebound recorded on Friday. As at the time of writing, it was at 23.25. Earlier in the day, it had rallied to a three-session high at 23.37.

A look at its daily chart shows that silver price continues to trade below the 25 and 50-day EMAs. This is an indication that the bears are still in control.

Besides, the two EMAs appear to be converging along the crucial level of 24.00. If the 25-day EMA drops below the 50-day one to the downside, the formation of a death cross will point to a further decline in silver price.

Based on both the fundamentals and technicals, I have a bearish inclination for the short term. In particular, the range between 22.85 and 23.66 will be worth watching. Even with the probable rebounding, 24.00 will likely remain a steady resistance zone for a while longer. On the lower side, strong US jobs data decline later in the week may yield further decline to 22.59.