Copper price edged higher on Friday as production disruptions in Peru heightened supply concerns. Later in the day, it will be interesting to see how the red metal reacts to US nonfarm payrolls based on its inverse correlation with the US dollar and status as an economic bellwether.

Supply concerns

Fears over low inventories is the main bullish factor as the financial markets approach the end of the trading week. Fresh production disruptions in the second-largest producer of the red metal – Peru – have heightened concerns at a time when stockpiles are relatively low. Peru’s Las Bambas, which accounts for 2% of the world’s copper supply, released a statement on Thursday stating that it has begun reducing its operations following the recent blockades.

Besides, Chile’s Cochilco reported that the country’s total output dropped by 4.27% in September. Notably, the South American nation is the leading producer of copper.

On Friday, copper inventories within LME warehouses declined by 5,375 tonnes to the lowest level since April. Similarly, stocks at SHFE warehouses dropped by 6.9%.

US dollar

Even with the bullish sentiment, a strong US dollar has curbed copper price gains as has been the case in recent weeks. As the market digests the recent interest rate hike by the Fed, the dollar index has remained above the resistance-turn-support zone of $112. Granted, it has eased on Friday’s session after hitting a two-week high in the previous session.

As is the case with other dollar-priced assets, a strong greenback makes copper more expensive for buyers holding other currencies. Investors are now keen on the US nonfarm payrolls set for release later on Friday; an aspect that will avail further directional cues for the dollar and copper price by extension.

Copper price prediction

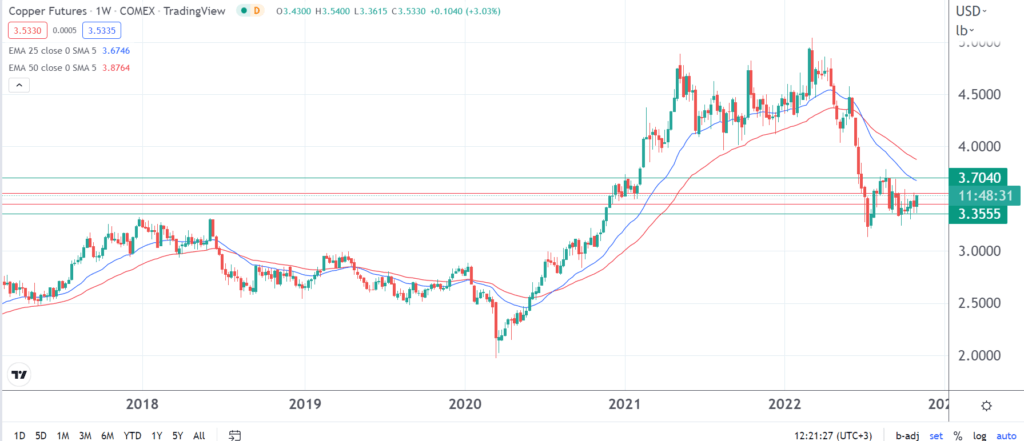

Copper price hovered around the critical level of 3.50 in early trading on Friday as diverging drivers remain at play. The red metal appears set to record its fourth week of gains over a span of six weeks.

Even so, it continues to trade below the 25 and 50-day exponential moving averages (EMAs). Based on both the fundamentals and technicals, I expect it to remain subject to curbed gains in the ensuing sessions.

In particular, copper price will likely remain below the previously steady support zone of 3.70. As such, the range between 3.55 and 3.45 will be worth watching in the short term. A further pullback will have the bulls strive to defend the support level at 3.35.