Copper price has continued to trade below the once steady support zone of $3.50 amid a strong US dollar and concerns over the world’s economic health. Even so, the long-term fundamentals remain bullish amid tight supplies and strong physical demand. As at the time of writing, it was down by 0.48% at $3.39.

Fundamentals

Bullish factors

For about a month now, COMEX copper futures have largely remained below the previously steady support zone of $3.50 per pound. This is despite the long-term fundamentals that are in favor of the red metal.

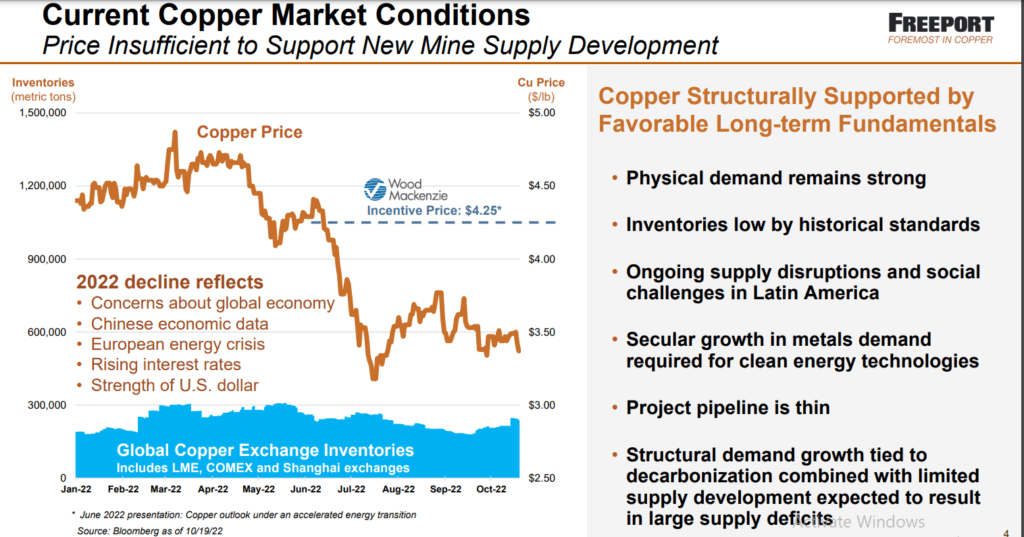

On the one hand, copper inventories are a historical low. According to Kostas Bintas, the co-head of metals and minerals trading at Trafigura, the stockpiles are currently at 4.9 days of global consumption. The company, which is among the world’s top commodity trader, forecasts a further decline to 2.7 days by the end of the year. Copper inventories are usually calculated in terms of weeks.

The Q3’22 conference call by Freeport-McMoRan Inc., the world’s largest publicly-traded producer of copper, further highlights the tight market. Besides, supply disruptions in key producing nations within Latin America and a strong physical demand sets the stage for the bulls to be in control.

Notably, these bullish factors explain why copper price has held steady above $3.25 after momentarily dropping below it in mid-July. In fact, I expect it to have found its short-term bottom at the year’s low of $3.13.

Reasons behind the downtrend

Interestingly, the aforementioned bullish factors have not been enough to boost copper price in recent months. In fact, it has dropped by over 30% over a span of 7 months. Concerns over the Chinese economy- the leading consumer of industrial metals – have been weighing on the red metal in recent months. In addition to the instabilities in its property market, weak economic data have also heightened the fears.

High inflation and aggressive rate hikes by major central banks also has traders alarmed over a probable global recession. Besides, a strong US dollar and the European energy crisis are at play in the copper market.

In the ensuing sessions, copper price will likely continue to find resistance at $3.50 even as $3.25 remains a steady support zone. More specifically, the range between $3.44 and $3.30 will be worth watching.